Bill Gross is one of the great heros when it comes to technology incubators. Twenty years ago, he founded Idealab, a business whose business plan is to create more businesses. This started out with just a handful of companies in 1996, and has since gone on to found 150 companies, that have collectively raised three and a half billion dollars. Out of these companies, more than half have either gone through successful IPOs and acquisitions, or are currently operating. That investment has generated a 13.5x return, and created more than 10,000 jobs.

Obviously, when you want to talk about what goes into a successful startup, Bill Gross is the person you want to talk to. We were happy to have him Keynote the Hackaday Superconference this year, and the lessons he shared might surprise you, especially if you’re interested in starting your own business.

Lessons for Startups:

Bill had a few lessons for the Supercon crowd and any entrepreneurs, summed up in seven points. First, timing is everything. Tesla would have failed if Elon founded it in the year 2000; battery technology just wasn’t there yet. Second, find an idea that is contrarian, but true. Again, our Elon provides another example — rocket science is rocket science, and the aerospace industry isn’t set up for disruption, because it’s all tied to government contracts. It turns out you can indeed build a rocket and find paying customers, even if you aren’t Boeing.

Bill had a few lessons for the Supercon crowd and any entrepreneurs, summed up in seven points. First, timing is everything. Tesla would have failed if Elon founded it in the year 2000; battery technology just wasn’t there yet. Second, find an idea that is contrarian, but true. Again, our Elon provides another example — rocket science is rocket science, and the aerospace industry isn’t set up for disruption, because it’s all tied to government contracts. It turns out you can indeed build a rocket and find paying customers, even if you aren’t Boeing.

Lessons for All Companies:

These are simple ideas, but the next few points Bill covered relate more to building a successful company and not just starting a company. The goal of any company is to be a successful company, and that means structuring the company with high equity participation. If employees are invested in a company, they will work harder. Also, product-market fit is all there is. You’ll need to iterate, and you need to keep your customers interested. The job of a company founder is to build a complementary team — you can’t do it all — and you should hire the best people, get the best investors, and motivate your team.

Although the Hackaday Superconference is nominally about hardware, more than a few of the attendees, and Hackaday readers, I’m sure, are interested in starting a business. We’re not all here just to build one of something, after all. Dozens of Hackaday Prize entries have gone on to become sustainable businesses, and even Hackaday writers dipped their toes into the waters of business development with their hardware designs; the Mooltipass, for example, was first developed on Hackaday.

Bill’s life story and the tips and tricks he’s learned from over thirty years and hundreds of businesses are invaluable for everyone. From his assurance that every endeavor will spend time in “The Dark Swamp of Despair”, to his dissection of the traits a complementary team needs for success, this is a fantastic talk everyone must watch.

Bill Gross: Things I Wish Someone Had Told Me 30 Years Ago

-

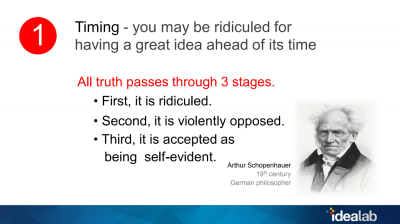

Timing– you may be ridiculed for having a great idea ahead of its time

-

Ideas– Find the contrarian idea that’s true

-

Don’t be dilution sensitive, be success sensitive

-

It’s not a little bit about product-market fit, it’s ALL about product-market fit

-

Persistence– The Emotional Journey of creating anything great

-

Build a complementary team– personality types & stages of a company

-

The Best Entrepreneurs are Good Story-tellers

“Tesla would have failed if Elon founded it in the year 2000”

Wait a minute that doesn’t sound right?

“Tesla was founded in July 2003, by engineers Martin Eberhard and Marc Tarpenning, under the name Tesla Motors.”

Elon did not found Tesla. He bought it. A company which had created good IP battery technology. Elon spent a massive pile of money on Tesla which he acquired by selling paypal. Let’s not erase the awesome engineers who helped create the battery technology which actually eventually made Elons business venture successful.

Um, they didnt create the battery technology. Lets not erase the awesome engineers at Panasonic who did.

…and still do. Tesla doesn’t produce all the cells they need on their own yet, and some of their products (e.g. the larger Powerpacks) are just relabeled Panasonic gear..

i think me means the rack system that allows the use of the off the shelf Panasonic batteries more efficiently then before

The idea of using laptop cells instead of proper prismatic large format cells for EV batteries was a hack to begin with, rife with problems like loose tabs that start battery fires, cooling issues, space issues… it’s actually one of the weakest points of Tesla’s engineering and a necessary consequence of going for the cheapest most available option back in the day.

Are the Idealabs Slides available for download ?

“Investing”, a revised meaning for the 21st century MBA:

Leveraging other people’s money, to gamble on a 1/23 success rate, and ultimately pushing out the principle shareholders.

Real business plans have risk, but shouldn’t require external investment to sustain a profit mode. Uber and Airbnb will not be around in 10 years — and most people know it… as what you observe as “timing”… I would call transitional hype for the credulous.

The Silicon Valley Technocracy of today would disappoint Steve Jobs.

https://www.youtube.com/watch?v=yL7X3DTyS2Q

Yeah, this guy is telling us the story he wants us to hear. This investor/VC cult propagates the ideas that benefit them best. Remember the lean startup? that was because of the credit crunch back then. Grow fast? that’s because they want a big payday, fast, not because it’s better for your company- it’s better for the one that wants to sell a pipe dream to another bagholder for a hefty premium. Worry about success, not dilution? of course, it’s the best for them -dilute you to oblivion, own a very successful business- not necessarily for your company! Find the contrarian idea, think big, blabla? of course you take all the risk, we only invest when you’ve reduced it with your hard work and since we have so many so-so ideas floating around, we’d love to see you waste your time for us finding the great ideas we’re too mediocre to come up with.

Btw, Jobs was an asshole

I agree, Wozniak was the better Steve.

” It turns out you can indeed build a rocket and find paying customers, even if you aren’t Boeing.”

Up until recently, SpaceX was funded pretty much solely by defense contractors and NASA, plus investments from Google, and taking government loans. They started out just like everyone else: selling to the US government. What makes it different is, the US government doesn’t make extra demands like having to maintain multiple redundant launch sites for military uses, so SpaceX gets to choose which services they offer at what price. They don’t want to launch to polar orbits because it’s expensive, okay, ULA has to do it instead.

That, plus the technology they got as handouts from NASA which made their R&D overhead minimal.

Turns out you can indeed build a rocket company if you already have a paying customer who is willing to hand you the product on a silver tray, give you cheap loans to develop your production capacity, make a deal to pay you billions to produce it, and let you make up the rules on how and where you will deliver it.

All you need to do is spin some cock and bull about “first principles thinking”, and start selling stock. Also, don’t forget, never put your own money in your own company; LEND the company the money and collect interest on the debt, so you get to extract more money on top of your salary, dividends, shares and bonuses.

Is the mooltipass really a good example? Reading between the lines, Stephan could have been much better supported by HaD and succeeded “despite”, rather than “because” of them. The project itself was a fantastic and possibly unique example of international collaboration. All in all, one of HaDs less glorious moments. And I say that as an impartial observer.

is there a blog or something about this? I remember when the mooltipass project first showed up on HaD and then just kind of dissappeared until it show back up one day and I always wondered what happened.

I agree

I am really missing things like:

– Protect your ideas.

– Don’t trust anyone.

– Keep a sharp lookout on your competitors, they WILL try to force you out of business any way they can.

– Protect your ideas.

– Protect your ideas.

When you are trying to raise money, many investors will listen to you, and decide not to invest. So you continue talking to other investors. Until you meet one investor who tells you that your idea is not unique, and that this other investor (one whom you’ve talked with before) is doing exactly that which you are trying to raise money for.

Investors WILL steal your idea if they can. Don’t doubt that. And if they find that you actually started producing your idea, they WILL protect their investment and try to force you out of business. And as they will have the prior art, their position will be quite strong.

That’s because the mantra is that ideas are worthless (according to them). Of course, most “ideas” are already in many people’s minds and aren’t worth that much, so it’s mostly true if you stick to the one-sentence version of the “idea”. But the devil is in the details and the full “idea” (the full plan) can be worth a lot. In their parlance that would be “execution”.

Anyway, if you want their money you have to spill the beans, which is reasonable. At least try to pick their brain in the process so the exchange is not so one-sided, and be prepared for them to use all the information against you down the road if they decide to back a competitor instead of you. It’s just common sense that things need to be this way.

I’ve heard #1 plenty. Think of all the streaming service that arrived a little too early like OnLive. The internet wasn’t good enough and the experience was poor. Now just a few years later, game streaming is coming back from even bigger companies.