It could be said that there are a number of factors behind the explosion of creativity in our community of hardware hackers over the last couple of decades, but one in particular that is beyond doubt is the ease with which it has been possible to import small orders from China. See something on AliExpress and it can be yours for a few quid, somewhere in a warehouse on the other side of the world it’s put into a grey shipping bag, and three weeks later it’s on your doorstep. This bounty has in no small part been aided by a favourable postage and taxation environment in which both low postage costs and a lack of customs duties on packages under a certain value conspire to render getting the product in front of you a fraction of the cost of buying the thing in the first place.

A Nasty Shock In Store For Euro Hardware Hackers

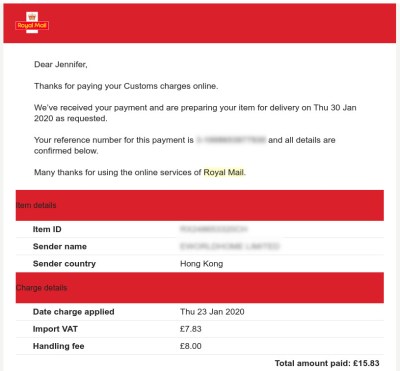

For people in the European Union though, all this could be about to come to an end. The catalyst for it all comes from Commission Delegated Regulation (EU) 2019/1143, which removes the purchase tax, or VAT, exemption on packages with a value less than 22 € and replaces it with a reduced-complexity declaration for packages under 150 €. Suddenly your Arduino clone will come with a VAT bill to pay, and since the current norm is for these charges to be collected by the courier before delivery, you’ll probably also have a hefty handling charge from your post office. The $2 electronic module now has not only a 20% tax added to it, but an extra ten dollars or so just for the privilege of being told that you owe them 40 cents. The days of easy access to the world of imported electronics could be over, and for Europeans at least it looks as though it might be time to step back a few decades.

Of course we’re not just talking about electronics hackers importing component pieces. The seeds of this situation have been sown over several years, with mounting concern over the activities of giant online companies such as Amazon and their use of loopholes in the complex EU tax environment resulting in a loss to the continent’s exchequers in the billions of Euros. This has resulted in a raft of proposals with the unfortunate side effect of gathering up small fry such as our community along with the big fish.

How then are the wheels of international commerce going to keep turning for Europeans after the end of this year? If we had the definitive answer to that we’d probably be off buying superyachts and private islands on our earnings as financial soothsayers instead of covering the world of tech, but it’s fair to say that nobody wants this type of trade to stop abruptly. The problem though is that while this law applies across all 27 EU member states, the VAT regimes of individual states are not harmonised. Thus any attempt to create a centralised VAT scheme in which the tax is prepaid at the point of ordering would run the risk of failure due to complexity.

Will There Be Shipping Chaos?

Larger sellers would be likely to try to circumvent this by locating their distribution infrastructure within the EU and taking the hit of working within the taxation framework rather than outside it. Some companies such as Amazon and Banggood already do this of course, but at the cost of much higher pricing for the EU-sourced item. The chances of a solution of this type that could work for a smaller business are thus not high, as how many AliExpress sellers working from a unit in Shenzhen have the resources to suddenly set up a warehouse in the EU?

Perhaps a new class of business will emerge, one of EU shippers who import orders from China in bulk and who enter into a shipping arrangement with the final customer in which they pay whatever duties are applicable from within the EU. Whatever happens the likely outcome will be that the customer pays more for the privilege of convenient shipping rather than risking an extra service charge to pay the VAT on a direct-shipped product before it can be delivered.

The key to this looming debacle lies in the one detail with which we haven’t been provided, namely how the tax is to be collected under the new scheme. The focus is on making the process easier for both seller and tax authority, with seemingly little thought for the end user. If they can arrive at a solution in which all that need be paid is the VAT itself then the extra 40 cents on our $2 Arduino clone will be of little consequence, but if they allow couriers to continue charging excessive fees for its collection then it will be game over for many of the orders we take for granted. This measure can only truly succeed if it is accompanied by meaningful regulation of these handling charges, otherwise not only will consumers of all types miss out on smaller orders, but the EU will miss out on its intended result of earning all the VAT they would generate.

This is being written not from the EU but from the United Kingdom, at present in the odd limbo of having left the EU but still being in a transitional phase in which we are still working under the same EU rules as before Brexit. Depending on the state of any deal the British government strike with the EU over this year we’ve been told that a tariff-free scheme will operate in the period following a no-deal Brexit, so it’s possible that for once in this context something could be falling in our favour. If so then we look forward to our EU-based friends visiting our hackerspaces to stock up on cheap tech the way we once visited France to stock up on cheap wine, but perhaps the overall benefit of this situation when considering the likely turmoil in other quarters will be marginal. Given that there have also been rumblings in the USA over the low cost of shipping from China, perhaps it’s time we all recognised that the party may to some extent be over.

Customs sign header image: MPD01605 / Public domain.

Buy your swag from Mouser …. They pay the customs taxes at their end and there’s no stinging handling charge. Also reminds me of some dealings with DHL, who not only added handling charges to my delivery but some ‘unspecified’ costs. Of course, I lodged a complaint and eventually got a full refund of all ‘handling’ fees for my beer drinking fund.

I was thinking that exactly, I’ll find another warehouse closeby, or it could mean that the falling purchases from the EU could mean EU warehouses could see the light, from which we buy the parts within our borders.

Electronics has CUSTOMS tax set on 0% other thing is VAT its a kin to US sales tax in case of imports the importer has to pay it – doesn’t matter if its private person or company, good thing is all big courier/transportation companies like DHL have their customs centers and they do it for you. Different case is sales inside EU if you are private person then VAT is added to your recipt and you pay it in country you bought your stuff (you pay shop and they pay their tax office) but if you are buying as company (VAT payer) then you get 0% VAT invoice and then pay the tax rate your country has. The best option for EU customer is look for EU warehouse option and choose it.

The only problem is that DHL takes €15,- if only one cent of tax or VAT is to be paid. That’s more then the usual shipping fees of about €7,- from places like Farnell. It is clear, that any handling costs more than the 40ct of VAT to be paid. That was the good reason for the €22 limit.

I foresee a move back to the days of smaller webshops in the EU specializing in certain products and having to order stuff from 20 different shops instead of the convenience of doing this through a single portal. I also foresee this being a HUGE boon for the likes of Amazon, and I’m not really wondering who is lobbying for these changes. This is going to suck for the average consumer most likely. In the Netherlands this tax declaration is being handled by the Dutch post agency, and they have the gall to ask €16,- (iirc) for the privilege.

I wonder if AliExpress (which provides a “standard shipping” option for a lot of the small stuff) might jump into the gap and generate automated tax filings.

> move back to … smaller webshops

Not possible.

EU regulations are quite strict when it comes to “to market” responsibilities. For a small shop, importing “unknown” goods from China (or anywhere, for that matter) nowadays bears a HUGE risk since that shop would be the “to market” point and would be responsible for adherence to all regulations applicable to the goods imported, including paying for the “electronic waste deposit lottery” that some countries have joined.

How could that be possible? That would mean that EU regulations result in unfair competition, indeed, I can order stuff from Aliexpress, even if it does not follow EU safety standards for instance, and it won’t be blocked by the customs…

When you buy your stuff directly from China, you are considered the importer and you are responsible to check whether the device was following all CE rules. If you cannot provide all the paperwork for that, the insurance companies won’t pay anything (in case of fire or injury) and if people die, you are resposible.

Furthermore, as importer, you are resposible to pay all kinds of taxes for waste and such.

That is how the rules are at the moment. So think twice before buying that 50cent ‘apple’ phone charger directly from China.

A couple of things:

1) That sounds like FUD. By your logic the insurance would ask for the receipts of every object in a house? What if the receipts were in the house that burned down?

2) However, that sure explains the “dropshipping” growth

3) I’m pretty sure that most phone chargers you get on a brick-and-mortar shop have the exact same origin.

The problem is that the customs are not doing any useful work. Indeed, if they did, they should actually stop all packages to individuals to start, and allow only those for registered importers (as it used to be the case), but FTA and free market brainwashing has got its way.

So it does results in unfair competition, way to go EU!

You know that an insurers main job to make sure that they don’t have to pay you so they won’t leave any stone unturned to make sure that they prove that it is your own fault.

Here is a good ( short) writeup about what you need to know about CE when importing.

https://www.chinaimportal.com/blog/ce-marking-importing-china-complete-guide/

And yes, before you ask, you are considered the importer as you buy items, produced in china, directly from china.

I agree with you that a lot of brick-and-mortar shop stuff is probably exactly the same as you would buy it yourself but the thing is that, because they imported it, they are responsible and liable.

I also completely agree on the fact that customs do not do a propper job.

Yet these shops already exist, mainly because most people don’t know / trust enough to buy directly from the Chinese sellers, so a market of importers have arisen that buy the same stuff and then re-sell it in whatever country.

One can buy a cheap item, like a nut, free shipping. If you then refuse to pay for the VAT and fees, the Royal Mail and friends have to return the goods. If every European hacker orders a few such items every month this will produce a lot of paper work and return mail costs for nothing. Will work as a kind of protest.

Oh yes, e.g I remember when The Man tried something like this (imposing paying handling fees) for free Data sheet CDs and component samples here in my backwater country. The practice failed fast, but there is apparently not only a sucker but also a sociopath too, born every minute, and idea of extorting people who have some little cheap satisfactions in life seems to spring into existence again every so often like some Phoenix bird.

Or you know you can just pay taxes, because with taxes you get healthcare, transportation, education and so on – we aren’t USA so we don’t pay for warmongering, we aren’t 3rd world or some dictatorship where we sopnsor some oligarchs. Every payvement you walk, every road you ride, every bus, tram, train, every tree in city park, every hospital you visit, every school your kids attend are paid from taxes. Control how taxes are spent but pay them fair and square.

Your argument is invalid. Of course we need to pay taxes, but imposing new taxes on peanuts, were the collection of them costs much more money and time than the few cents gain for the state is just wasting time and money all together.

That’s not the point of this article. I’ll gladly pay 20% tax on imported electronics. I don’t want to pay 500% of the cost in bullshit fees to a courier for the privilege of being told I need to pay tax.

Except that the point of extending VAT on these products is to stop the import of petty cash items individually through the mail – because the shipping actually costs the EU countries more than the value of these products.

They’re abusing the international postage/customs/tax loopholes and China is subsidizing companies that make these trinkets for export, making the shipping essentially free. There’s no other way you can send a dollar value item all the way across the globe. For a few cents more in price, someone would make the same plastic trinket in Romania or Italy and cost the whole economy less, but China wants the money more. They’re engaging in predatory business practices because they want to keep the western competition down.

The profits go to the political elites who own the companies while the costs go to the Chinese and the EU taxpayers who pay the export subsidies and the shipping costs, so it doesn’t matter that they’re technically selling stuff at a loss.

Deal !

Unfortunately not all the post companies will return the goods back to China if you don’t pay. Some post companies do prefer to sell them in load to junk dealers, and make money out of them.

In Belgium for instance, it’s not uncommon to see these not delivered parcels/bubble wraps from China on flea markets. Some junk dealers have tons of these packets to sell, often with the original recipient name/address still present on the bubble wraps… And I’ve seen recipients addresses for different European countries on these “not delivered parcels”, not just local Belgian market. Post companies I’ve seen on the bubble wrap labels were: B-Post, Luxembourg Post and NL Post.

I’ve bought many accessories this way from this kind of second-market (SBC, TV boxes, BT speaker, soldering stuff, vape accessories, electronic components, etc…) cheaper than buying them on AliExpress, Banggood, Gearbest,…

This is an interesting approach. How does this work, do you get to see what is inside the package? how do they know what to charge for the stuff they sell?

I’ve only seen that from an end-customer point-of-view of several junk dealers. But not just one time, many times on the Belgian market.

Some sellers do open every package individually an expose the goods nicely to their customers, some other just put all wraps in big cardboard boxes and you’ve got to dig between opened, half-opened or even not opened wraps (that you’ve got to open by yourself before buying to check what’s inside). Some pictures https://imgur.com/a/zdhanHf (I’ve pixelized names on wraps).

Some sellers more oriented on margins take time to check item prices on Aliexpress and sell items under the retail price on ali (for instance I’ve bought a Xiaomi Mi Box at 16€, Xiaomi BT speaker at 7€, HDD-USB3 enclosure at 2€). Some sellers more oriented on volumes just sell items at 0,5€ or 1€ the item (so sometimes it’s a good deal, sometimes not).

But at post company level, I imagine they do sell that in batches, like a batch of 500/1000 yellow or grey closed wraps from China, and probably with bid sales, just like some custom offices do when they seize items.

Cool, thanks for the info!

Where can I find these flea markets?

@Torre : Brussels area. But it may happens in other places in Belgium (as flea markets is like a national sport in Belgium). In Brussels usually the flea markets season starts around mid-April and there is at least one flea market per week-end (sometimes many per week-end) as each neighbourhood organise its own flea market.

But I don’t know how things gonna turn this year with covid-19…

If everyone does that, that also generates waste for the Chinese companies which means they will ban those countries that get involved in this practice.

Eventually they’re going to run out of other peoples’ money.

+1

We have had basic cost of import packages of 79 sek since last year, sometimes vat comes on top,

Wish have made a deal with the Swedish customs to Bill sell with Swedish vat included in initial order so we avoid this cost.

No such deal with Aliexpress.

The Swedish customs authority have though stated that they are open for other negotiating the same agreement with other such services. Though, most companies don’t really shift through the numerous countries official statements.

But yes, the idea of paying import tax on stuff one orders from outside the EU isn’t a new thing. (It has always been there…) The only difference is that cheap packages aren’t tax excepted any longer. (Though, personally I tend to make large enough orders for the package to be taxed regardless…..)

And only reason they were tax excepted to start with were because such packages were commercial samples, not actual products.

It were intended as a way to make stores able to import smaller package to see what various products are like, without the customs agencies needing to hassle with filing taxes on these generally fairly worthless packages, since the packages were supposed to be fairly “rare”. (One big reason for why most customs declarations are quoted as either being a “commercial sample” or a “gift”. Since gifts sometimes also free from import tax in some countries.)

That the internet came along together with larger logistics companies able to handle thousands of packages without much hassle that then flooded this “commercial sample” avenue weren’t the idea. And obviously would lead to this tax exemption being revoked at some point along the line.

Though, the thing I think is stupid is that one can’t just skitter off to the local post office and pay the import tax and the handling fee there…. Tried the small ones (postombud) and the large offices, but nope….

Customs tax is one thing then theres VAT, customs on many things from china are set on 0% like electronicsx, phones and so on but the VAT is still there and your responsibility as importer is to pay it.

The reason was not only commercial samples but also that the gain in tax money is also less than the effort to collect and account for tiny amounts of money. If the handling fees and the handling cost on the offcial state side (eg. IRS) side are more than the tax then it is just stupid to collect this tax. It is just wasting a greater amount of money to get a small amount.

In somewhat related news, Aliexpress has recently started collecting sales tax for many (if not all) US buyers. The reason for doing so appears to be due to the fact that the parent company Alibaba has an office in the US. Hopefully we’ll see some new platforms that has no physical ties to the US and thus not give a rat’s end about collecting sales tax.

“No physical” ties means no business in the US. It may not be sales tax in the end, but there will be some kind of exchange between the two.

Sadly, this article mostly shows two properties I find quite common in people from the UK: the innate lack of knowledge about the EU as well as the persistent urge to dramatize pretty much everything.

Yes, this bill will remove the tax exemption for cheap goods (<22€) and replace it with two options. Either the 'normal' taxing scheme, or the I-OSS procedure: a system where suppliers digitally declare the goods before shipping and collect the taxes. The parcel will then be (digitally) marked as tax exempt and will not even have to pass customs anymore.

For the purposes of collecting taxes, this bill specifically names the platform collecting the money from the customer as supplier. So AliExpress / Banggood / etc will be the ones having to deal with this, not the 'small Chinese companies' that actually own the product. Also, it states that, again for tax purposes, items will be deemed delivered when the payment is made and the VAT amount will be calculated based on -only- the country the item is shipped to.

So, no, prepaid taxes will not be 'complex' for a platform like AliExpress. In fact, it will make the buying experience much more streamlined and remove the uncertainty caused by local customs. They will have to collect taxes, like they already do for quite a lot of countries. Those taxes will be calculated by simply comparing the destination country to a digitally provided list of 27 member states, with a percentage next to it.

Yes, UK people are an odd bunch to be fair.

Meanwhile over in Sweden where I live, we have payed import tax on all packages originating outside the EU for the last couple of years. (And back when there were such a thing as tax free, then it only applied to packages bellow 150€ or so. IIRC.)

The “tax exemption” were technically not meant for the mass market consumerism we see today.

It is an old solution to the problem of not wanting to hassle with cheap packages that would frankly cost more to just declare tax on, than what the tax would even be worth… And back before the days of the internet, these packages were fairly rare.

It is the main reason why the customs declaration is either filled out with:

“commercial sample” (Literally a sample of a product, for a store to be able to evaluate the product quality ahead of a larger order.)

Or as “Gift” (In some countries, gifts are free of tax. Though, most gifts tends to be of little value, it is also a way to send stuff to a friend elsewhere, and such.)

Declaring the sale of a product isn’t even an option on CN22 customs declaration label. (the most commonly used document for declaring the contents of a package.)

Again the customs tax and VAT are two different taxes!

> Those taxes will be calculated by simply comparing the destination country to a digitally provided list of 27 member states, with a percentage next to it.

Did you know that the VAT on SD cards is only 7% in my country instead of 19% if the sole contents of the card is an audio recording of someone reading a book?

Time to setup a Chinese company that puts .ogg audio book files, from a public domain book, on SD card.

I rather resent that kind of statement, it reveals an innate lack of knowledge about the UK. Sure, we have some idiots, but I think that applies to everywhere equally.

“a digitally provided list of 27 member states, with a percentage next to it.”

Luxembourg was profiting of all the VAT taxes of all Amazon orders in Europe, that gave birth to a CJEU decision which said the VAT rate had to be the one of the country of the buyer, which is logical. I have seen some business groups complaining about this, saying since the VAT rate is not harmonized across the EU, they had to deal with this complexity.

They should never ever created the EU without first harmonizing the fiscal rules, even Nobel prized economics recognize that creating common currencies without harmonizing fiscality is creating a 2 speed Europe, where some countries pay a lot more then the others.

Some EU countries are fiscal paradises, such Holland where Ikea and all other large companies pay 0% taxes via patent/design/copyright royalties:

https://en.wikipedia.org/wiki/Dutch_Sandwich

Harmonizing the tax code would be de-facto federalization of the EU, and would basically lead to WW3.

We should never ever created the EU!

The UK already has a different rule. Here it’s Duty Exempt under the value of £14.

With Brexit there was talk of reducing the threshold to zero, but that’s another matter.

When buying far east parts on ebay uk. Options:

1) you pay for it from china. It costs the least. It takes a while to turn up. If it’s faulty you must by ebay rules send back to china.

2) you buy from a china seller based in UK. You pay a bit more, it ships faster. They drop ship to a storage warehouse, you buy. The parts are picked and shiped from UK. If any faults under ebay rules you return to UK. China seller cannot accept this and so will refund you (there is a dance they do on value of feedback vs value of item which is culturally amusing) or ebay will. 100% every time.

3) you buy from a uk based seller. You pay a bit more still but they will accept returns.

Personally I see no advantage to option 3 over option 2 now. There was a few years ago but it changed with ebays terms. So I use option 2 every time I buy something origin China. I get a lot of refunds due to crap product or mis-selling, but I win every time as their business model means they cannot follow the rules.

The Chinese sellers setup option 2 to cut out the middleman so to say. The guys in the UK who were importing from them in bulk and reselling. The China sellers cut them out. But they cannot take returns back to a storage warehouse. There was also a big noise about these sellers avoiding VAT with this method so they are all now quoting VAT numbers for Chinese registered companies.

So it’s for me the best way to buy.

You pay slightly more, but if what turns up is poor quality, you get a refund. No ifs or buts.

It’s risk free shopping.

Top refund so far £200 under this method. You to dispose of the faulty product.

As someone living outside the EU but inside the EEA, we here in Iceland have had to deal with similar taxes and fees for about a year now, and no, it ain’t pretty. Mail service here was never particularly fast, mail used to be delivered 3 times a week, envelope-style ‘packages’ (for instance electronic parts) below a certain value would be dropped right in your mailbox, no taxes no fees. This all changed a year ago. Now mail is delivered only twice a week, and ANY PACKAGE even if it’s in a letter envelope or half envelope (Ever order SMD parts? They ain’t big!) has to be picked up at the mail office in town. Of course there’s taxes on everything now, even the smallest little package, plus there’s a ‘handling fee’ of around $10 per package. Amazon doesn’t deliver 99% of their goods here, shipping from both europe and especially the US is prohibitively expensive if companies offer to ship to iceland AT ALL, so what remains is ordering from china. Be prepared to wait for 8-12 weeks for everything you buy on ebay. There’s a total of two local hobbystores that cater to the electronics crowd in the country, both are very expensive and moreoften than not will not have whatever special part you just happen to need. So you learn to arrange with the situation. You plan in a wait of 2-3 months when working on hobby projects, you work on many projects at once to beat the ‘shipping latency’ via multithreading… and -ever since that tax+handling fee thing has been introduced, you either buy as many things from the same seller as possible so they’re all in one order, or you buy MORE. Paying a $10 handling fee on that 50ct integrated circuit or $1 doodad doesn’t pay, so you buy a dozen of them to offset the handling fee, hoping that you’ll need the extra stock in future projects. What REALLY would be a game changer for the situation would be a mail consolidation service somewhere down in hongkong or shenzen. You get all your orders shipped there, and once a month they drop it all into a big box and forward it to you. That’d make it so much cheaper, at the cost of an additional few weeks of wait.

Yes, these handling fees are the real problem with the new regulation

By “consolidation service” you mean like a local (EU based then) warehouse? That already exists: Mouser, Farnell, Digikey, and so on.

Such services exist, just search for “taobao agent”. A big one is superbuy.com. Buying through taobao can be cheaper than ebay/aliexpress and the selection is larger, but you can order from anywhere that will ship to the chinese warehouse.

Here In Canada I have noticed since the beginning of 2019 that shipping from china is in most cases more then the item that I want. So My ordering any electronics has almost stopped. And there is no dumpster diving allowed here as well.

It is so so sad to got to the Dump and not allowed to take any of the garbage. So So sad.

I’ve been vary temped to visit local dump sites to rummage through the ewaste. Don’t know what Waste Industries(who runs the dump sites) official policy on doing so.

There’s Policy, and then there’s Policy Implementation. The guy freezing his backside off for twelve bucks an hour doesn’t care what you scavenge as long as his boss isn’t looking.

No dump diving here (Australia ) either :(

Ugh.. I’m in Ottawa and they have pretty much closed all E recyclers to the public.. A quick trip to a depot and much of the parts needed were in hand. Now.. nadda..

Well, it’s a great idea to kill off all small businesses that rely on stuff imported from China. Especially now, when next financial crisis looms at the horizon, and Coronavirus accelerated its coming. Near my home there is a store that sells cheap junk from China, they will probably go out of the business because of that and because of virus panic which causes all packages to be locked up in quarantine…

Also legislation that governs VAT tax in my country is so complex and changes so often, that few months ago a leading expert in the field said that he doesn’t understand it anymore because there are too many changes…

> Well, it’s a great idea to kill off all small businesses that rely on stuff imported from China.

In fairness, how many local companies do you think have struggled to compete because you can order a cheap clone from China which may have ripped off someone else’s design anyway, further reducing the costs? That’s something which people here have always spoken about as a plus, but it just pushed the human and environmental cost to somewhere with more lax rules. I’m pretty certain that’s why many companies put real emphasis on creativity rather than just “here’s a temperature sensor”.

This may have been agreed in 2017 in which case companies have had a few years to prepare.

https://ec.europa.eu/commission/presscorner/detail/en/MEMO_16_3746

When I first wanted to order a PCB, I started with one of three local companies that make them in my country. I decided to order from China, because each of local ones charged for setup fee to make 2-layer board more than any Chinese factory for batch of 10 4-layer boards with rush fee. Not only that, but local manufacturers charged extra for each hole and each different diameter. So I voted with my wallet. The way hackers, makers and ordinary people did. And there are many, many small, online businesses that sell stuff from Aliexress or Wish on local clone of Ebay. They too will be out of business, because their margins were very tiny…

>They too will be out of business, because their margins were very tiny…

Right, but again their margins are tiny at least in part because they need to give people a reason to buy from them rather than getting stuff for dirt cheap directly from a Chinese seller which dodges the VAT, which isn’t a trivial sum. I’m not saying that this change is universally good, but the reason it is being changed is that it gave direct imports an unfair price advantage which local companies couldn’t take advantage of, so it was unfair to local sellers.

Thankfully there are more hobbyist PCB manufacturers these days, and even some based in Europe and the USA which have pretty reasonable prices. They might be slightly more expensive than the Chinese fabs but in my experience the parts arrive a lot faster, which I’m happy enough to pay a little extra for.

The Chinese government subsidizes companies that manufacture only for export. This is both protectionism of their own markets (local sellers get full prices), and killing off competition in the west because they know they can make the money back on the larger orders.

Making small orders at a loss is the hook that the Chines company uses to catch the bigger jobs that actually pay the money, and since the government is paying part of the cost it’s not actually a loss to them. Meanwhile, your local companies have to make even the small jobs pay because they’re catering to a much smaller number of customers that even know they exist.

The last time when the economy wasn’t doing well, those Dollar stores business boomed as people have less disposable income to buy things at the regular stores. Without them, it would make life worse for some people.

My local dollar store also sold (inferior) local products e.g. bread, household cleaners that wouldn’t make sense to ship from China. They also sold soft drinks cans/bottles below the convenient store charges.

I learned the hard way that when you don’t have much money, you can’t afford to buy cheap junk. Or, as my father used to say: poor looses twice…

Yeah but “A high price is no guarantee of quality” is also true.

I’m a resident in Gibraltar that is not part of the EU customs union..

I just bought a large flat screen TV over the border in Spain.

I asked for a ‘Tax Free’ invoice and when arriving on the Spanish -Gib border, I went into the Spanish customs and Flashed the purchase invoice bar code into their machine.

The 21% IVA tax has now been refunded to my credit card. When passing into Gibraltar, being a good citizen, I declared the TV to the Gib customs officer who said…..That’s OK sir, there’s no duty payable on TVs.

Other stuff I buy from the States or China or other EU states hardly ever incurs any import taxes.

Something is a bit twisted when I can buy a small item all the way from China, and have it delivered to my door, for less than it would cost me to post the same item to my friend in the next town using the very same postal service that delivered it to my door. (UK)

It is easily solved, for the UK to pay the same “terminal dues” as China it just needs to be classified within the UPU (Universal postal Union) as a “developing country” instead of a “developed country”.

When you ship a package from your country (UK) to China, Royal Post’s part stops after the package is packed onto the plane. China Post takes over the last mile to the destination. It would be silly for the postal office of each countries to duplicate that network in every other countries.

There is an international postal agreement in place such that each local postal systems delivery mail/packages to their local destinations. Since countries have different wages/standards of living, somewhere in there are agreements that let a poor country ship mail/packages within their economics means. i.e. you wouldn’t need a month’s salary to mail to a “rich” country from a sh*thole. Somehow this China ship for cheap as they were “poor” until the last 20 years. Other countries would still want to be able to delivery to China as they are a huge market, so nothing was done to change this. US is pulling out of that agreement.

China is abusing the international post treaties, and every other advanced country is paying for it. I kid you not. They are still classified as “poor” and not sending much, so they get cheap deals when exporting parcels like a tsunami.

The system is old, and assumed exports and imports are more or less equal for everyone, so poor countries can ship things to rich ones and their citizens don’t pay a lot, while in rich countries pay higher yet acceptable rates to send to the poor. In the end the balance should be neutral. But in reality that is not in the current situation.

When a poor country sends a lot and receives small amounts, the system fails and the rich countries have to raise local fees to compensate the loss. Then the poor country uses that to even make their deals even sweeter, with the rich places losing competitiveness by having prices even higher than then should.

It was big news in forums for sellers (Ebay and family owned brick-and-mortar) years ago. If you dig enough, you will see it is not just USA, but other countries too.

http://web.archive.org/web/20141218003401/https://www.washingtonpost.com/news/storyline/wp/2014/09/12/the-postal-service-is-losing-millions-a-year-to-help-you-buy-cheap-stuff-from-china/

http://web.archive.org/web/20130701221629/http://www.ecommercebytes.com/C/letters/blog.pl?/pl/2012/4/1334191984.html

http://web.archive.org/web/20200310230704/https://news.ycombinator.com/item?id=9794971

But hey, smart Western CEOs, keep on sending everything abroad… and see who can play smarter. The forced partnership to create companies in China should have been a clue.

Here in New Zealand the government has insisted that AliExpress collects GST (our equivalent of VAT) when an order is placed. This started last year. We also have a minimum amount below which Customs duties are waived.

So, when I order from AliExpress I pay tax at that time (which I hope actually gets remitted to the government here) and no duty when the package arrives (unless it is very high value).

People here moaned about it, but GST on a $1 item is not huge. The same item would cost $10 here if you could even find it.

Luckily the plucky Brits have thrown off the yoke of EU oppression, so although this tax will hang around during the transition period it will be the first thing to go once Boris is fully in charge.

The same happened here in Aus – the main thing that the local retailers wanted was the handling fee – as that is what kills small orders.

The actual gst (out VAT) is irrelevant – adding 10% to an item that I either can’t buy at a store in Aus, or can by for 5 times the cost, doesn’t change my purchasing decision…

However, they lucked out with the final model – as the person sending it clooects the tac and theoretically sends it to the Aus government. So Aliexpress adds 10% to everything, and who knows how much actually goes to the government.

So I strongly encourage EU hackers to oppose the handling fee, not the tax. It’s a much easier thing to do, and is the real problem..

Yes, the problem will be the handling fees.

Its not just Aliexpress who now collect the GST for the government, eBay australia also add the GST onto all orders including from any overseas supplier (it doesn’t seem to matter where that supplier is)

Also, all overseas companies who want to sell products into Australia are required to register with the Australian Tax Office and collect GST on sales and remit it to the ATO. (I think there may be a threshold on turnover of the company before it has to register and collect GST, like there is inside Australia, but I don’t know the full details)

This can lead to some crazy situations for local vendors, whose turnover is below the GST registration threshold, hence are not registered for GST and don’t collect it when selling direct to the customer, but when the same vendor sells through any American online marketplace e.g. Etsy, the products have GST added to the price.

So the knock on effects of this are much wider than it initially appears.

But if post start take handling fee also from low cost items there is way to put stop to it. Lets just order s* load of <1usd items from china and refuse to pay handling fees. They will do something at point when they have millions of packets in return queue

Good. That cheap clone you bought, likely has stolen and unlicensed IP. The race to the bottom has hurt Western engineers.

No. you get prices raised everywhere. We already have this in Russia. Local price is from 1.2 up to 2-3 times more than the price of originals. Availability is shitty (‘sure, 3-4 weeks’ for non-mainstream stuff. can easily be closer to 5).

To the point that importing stuff was much cheaper than buying local. Yes, even with non-free shipping.

This comment does not do justice to companies like Espressif (there are plenty of others too). Plenty of IP is generated in Asia these days, and broad sweeping statements about products made here are no longer relevant.

“likely has stolen and unlicensed IP”

Virtual property cannot be stolen, it’s not a rival good.

Can be downloaded from pirate-bay though. Anyone want a car?

Well, if I may quote Homer Simpson, “When it comes to compliments, women are ravenous blood-sucking monsters always want’n more…more… MORE! And if you give it to them, you’ll get plenty back in return.” Now just replace “compliments” with “taxes”, “women” with “governments” and “plenty” with “f**k all” and you have a complete explanation of this situation.

“so it’s possible that for once in this context something could be falling in our favour. If so then we look forward to our EU-based friends visiting our hackerspaces to stock up on cheap tech the way we once visited France to stock up on cheap wine”

No such luck these new rules on closing the €22 / £15 loophole is actually one place where the EU is taking post brexit British Law and applying it to themselves. It became law in the UK in 2018, and will apply as soon as the transition period is over with a £135 limit for overseas shops collecting the VAT on your behalf.

https://www.gov.uk/government/publications/hmrc-impact-assessment-for-the-vat-treatment-of-low-value-parcels/hmrc-impact-assessment-for-the-vat-treatment-of-low-value-parcels

About 9 years ago I worked out it was cheaper to relocate myself than all those components (also lower taxes). So I quit my job and moved to Asia.

Problem solved!

That’s dedication to a hobby, man!

I came to the same conclusion when I wanted to open an online shop similar to Adafruit for Europe.

It was cheaper to relocate to Schenzen and ship from there.

How can you compete if shipping from China to your country is cheaper then sending a package to someone on the other side of the street?

Trump wanted to leave the UPU by end of october 2019, I have not heard anything new since then.

The reason this is being introduced is simply because it’s too difficult to change the international postal treaties that allows the Chinese to send parcels at no cost, which is a huge financial drain on the postal services in the recipient countries (Chinese post subsidies means it actually costs your local postal service money to deliver those eBay parcels).

Back when CDs were still a thing, many EU countries lowered the limit on duties worth collecting due to companies routing CDs and DVDs via Jersey, Åland, and other loophole places.

Re your first point, is that because of the old postal treaty where the countries all agreed to deliver international mail headed into their country for free, and get the same in return?

That was a nice simple idea when people sent each other penpal letters occasionally, and nobody would order anything from China because even if you got the catalogue after 6 months, you wouldn’t be able to read it, or get the money sent safely and cheaply to China. And if they ripped you off there’s bugger-all chance of you taking them to court.

Seems like some countries need to renegotiate. Ebay has had a worldwide impact. China must have a massive inbalance in incoming : outgoing mail. Particularly packages. Perhaps you could just negotiate an exception for packages, and keep letters still free. The treaty was not imagined for a world where trade is like it is now. Basically all manufacturing in one country and their evil totalitarian govt subsidising their mail.

Still a similar thing applies to the USA and entertainment. So much entertainment is sent through the aether of the Internet. No physical object to tax. A vast amount of entertainment emits from the USA to be consumed around the world. Are governments going to try taxing that, one day, as imports? The US media bastards will SCREAM at that one! And since the American government are worthless whores, they’ll do as their paymasters tell them.

Anyway… two wrongs, and never expect a business to act less than abominably. If there’s a particular profit in it, expect much worse than that.

Question:

Having just last week bought a BLDC controller from Aliexpress and had to pay the import and post office gift for being kind enough to collect it for me I found the controller faulty.

What is the procedure to make sure I don’t pay on the replacement? Do I have to prove I sent the old one back?

Generally I don’t mind paying import at all, I am sure that some houses still have some room for more plastic recycling bins in their yards and the government need to pay for more of those.

You have to send it through your local customs office with a special procedure…

Actually that’s a significant problem. Doing no QA at all, and having their stuff assembled by drug-addled monkeys with spanners, is how China works. Then when 10% or 20% of them fail, they just press the “refund” button on Ebay, or send you another one. The customer does all the QA testing, and postage is so cheap that it works out economically.

A high failure rate, and not worrying about it, is part of the whole system and hasn’t caused a problem so far. As Steve says, there’s a system in place to deal with that, but I bet “fast, efficient, and reasonably priced” aren’t words you’d ever use to describe it. Apart from “and” maybe.

I wonder how that’s gonna bubble up? Probably in the end will just be a system where vendor pays VAT and wires it to government direct. So the crap non-QA can continue. Oh good.

Actually in the EU manufacturers have to take some responsibility for eventual disposal and recycling of their products, Der Grune Punkt etc. How does that work with China turning our homes and garages into electronic scrap dumping sites?

” How does that work with China turning our homes and garages into electronic scrap dumping sites?”

Seems fair. We kept trying to dump our trash in their country.

Ive been noticing of late Chinese sellers have been not refunding as readily as they used to offering now only a partial refund.

If this turns into Aliexpress/ebay etc charging me extra ~20% tax and having everything done by them and nothing else changes, then it will be reasonably ok.

If it turns into a clusterf***k of effort and money like I am seeing now with packages in the higher price range, then it will be bad. VAT is fine, but DHL and other couriers are charging 30+ EUR for processing this for me. Post is slightly less, but still a lot.

If this would be the case, I would just see myself making sure to buy lots of things, if the processing fee is fixed, might as well maximize the value of the packages. But what do you do when you have everything except that $2 module..?

Same here. I don’t mind paying the regular 21% tax on import, but your package being held hostage and being extorted to pay EUR18 or more extra just for the last few kilometers annoys me to no end.

On the other hand. a 50ct package with free shipping from China is simply ridiculous. It was fun while it lasted, but it would not last forever. As a simple buyer I simply do not know what the real shipping costs are for a small packet from China. EUR15 for the airplane (and the other EUR3 VAT)) may actually be close to the real costs. This will completely obliterate the “50ct package with Free shipping”, and though I abused this much, it was a ridiculous situation which could never last.

Another issue not mentioned here is RoHS. I find it hard to believe those Blue Pills and many other breakout boards are RoHS compliant. And with shipping tightening up, that may be addressed also in the future.

The problem has never been the tax itself, I can pay 25% (the local tax) on everything I order from other countries, the problem is the handling fee and the delay that comes with it.

I recently ordered stuff from china, feb 15 it left china and I started tracking it.

All movement stopped feb 23 with “Left china for Sweden”

After asking for a refund from the seller, he started chasing the package down, and it was indeed in Sweden already, at the import handling facility, but they hadn’t gotten around to sending me a demand for handling and the 25%.

Since it was a cheap of a circuitboard, 25% added up to nothing, but they still want 99SEK ($10) for handeling my parcel.

I am effectively paying them to delay my parcels, not the tax.

(To be more clear: the only case when an Arduino clone is legal is when it does not claim to be an Arduino)

This article is wrong!

At least in Denmark. Until 2021, “some” (Since not all seem to be “caught”) orders above 80 dkk (around 12 dollars) will have a handling fee and VAT applied to it. The handling fee is constant at 160 dkk (24 dollars! Over 200% for orders at 80 dkk!), and the usual VAT in denmark, which is 25%. This means that purchasing bigger circuits that are impossible to find locally, custom fabricated PCB’s, CNC/ some 3D-printer parts (Bigger stepper-motors, spindles, high-quality controllers) and a lot of other things are basically unobtainable from outside the EU, unless you want to pay a LOT more for it, and if they are, you would split them up in several packages(Wasting resources for everyone!) to avoid the fee.

The new rules make it so everything will have the 25% VAT, but since the system is the same for the whole EU, international sellers such as Ebay and Aliexpress will have an interest in implementing and using them, which means the handling fee disappears! So with the new system a 10 dollar part will cost 12.5 dollars, but a 20 dollar part wont cost 50 dollars !

I have no trouble paying that 25% VAT, but the old system where the postal service had to find a packages value and then store it for up to 28 days, while they send me a letter with a bill to pay, and then have to find the exact package and forward it to me, was just plain stupid. The postal service several times made statements that they are not earning anything from that system, and i believe them!

Heh, so that old joke about postal systems that says out of the 100 currency unit cost, 10 units are for transport and 90 units are for storage, is true.

“I love all my government provided (mandated) programs so I don’t mind paying high taxes!” “ok, pay taxes on this stuff” *surprised pikachu face*

Disconnect brain from gob and re-connect eyes. The problem isn’t the 20% tax itself. It’s that, if the courier is going to be the person responsible for collecting that tax, they add on a collection fee that can be way more than the tax or even the purchase price. That’s the problem. Not the amount of the tax but how it’s being applied.

But there are ways round this that governments, suppliers, and couriers / post offices can come up with. It will certainly be in their interest too. China’s totalitarian government subsidising export postal charges, to rig the international market for plastic crap, have been an incalculable boon to their manufacturers, at least when they’re not busy trying to talk their employees back down off the ledge, or power-hosing them off the front path.

The Chinese have been buying foreign currency in big amounts and stuffing it down the back of an enormous couch (“The Great Couch”, in fact), to keep exchange rates from doing what they’d normally do to balance out trade.

All of this dickery isn’t going to be foiled by adding VAT to small packages. China’s Big Plans seem to rely on this state continuing for a while yet. Tax can be paid electronically and in lots of ways.

I’m with a lot of other commenter on here.

No objection to tax or for that matter more realistic p and p fees.

But the handling charge is the kick in the nuts nobody likes.

If the seller platforms handle this, I think that’s the best option.

If that ends up not being the case I may do what others have suggested and keep ordering cheap stuff to random addresses so royal snail decided they need to speak to someone about changing the system.

as a business customer i´m liable to declare the vat and duties myself in sweden. Works fine with dhl and fedex but the swedish post always charges this fucking 8usd handling fee on top. the bigher actors on ebay and aliexpress seem to circumvent this and ship theit stuff from countries like poland and czeck republic. No vat, no duties, invoice with chinese address upon request.

Drastically reduced my experiments with the now absent 1 dollar orders from aliexpress but to be honest it is probably better for the environmant that i don´t get 50 letters a month from china.

still this regulation harms the small frelancers and plays in the hands of the bigger players

These handling charges need to be made illegal. The customs process needs to be followed regardless of the value of the package contents, and this should be included in the shipping cost.

It is not a complex process to add required duties during postage calculation.

All postal services should be required to do this by law instead of making it the responsibility of the purchaser, then demanding extra money for doing their job.

The whole EU is just one big GULAG. Should be dismantled before it collapses onto our heads.

Hackers, this rule is running since Jan 1st, any customer experience?

I haven’t experienced any change while ordering items from China to Belgium on eBay or Ali.

But in 2020 I’ve ordered way less from China than previous years. Two reasons for that:

1. Covid-19: shipments were delayed and B-Post at a time almost collapsed under imports from China (I had parcels arrived from China and stuck during 3 or 4 months in the Belgian logistic system).

2. I could find almost all items I wanted directly on the local second-market (undelivered B-Post parcels and custom seizures). I’ve got a couple of drawers full of interesting items (esp32 boards, sensors, servos, sonoff wifi plugs, LED strips, etc…) that I’ve bought here in Belgium in September/October and cheaper than from China.

I believe it has been postponed till July

https://www.belastingdienst.nl/wps/wcm/connect/bldcontentnl/berichten/nieuws/douane/uitstel-ingangsdatum-nieuwe-eu-btw-richtlijn-e-commerce?fbclid=IwAR3rbeAhtQoVLCJmR8Zk4ZibzUgTTO3K4wMMmIn35RRKumQvp1mnCoW0dII

unfortunately in Dutch

There is something called IOSS.. coming in EU … not sure if anyone has commented yet… But basically it lets items go through un stopped and you collect and pay the tax to the EU country- you register with… Am wondering if … you sell something $100.. if you posted it youd in theory be liable to senf the 20$ tax value… IS there anything to stop you charging on the store $1 ( for the $100 item ) and bundling with a $99 item which you “store” for a customer but dont post .. so presumablly it will not attract the tax as it isnt entering the EU???