Bitcoin. The magical internet money is often derided as “worthless” and “made up” by those who forget that all currencies only have value because we believe in them. Perhaps the world’s strongest currency not backed up by guns and ammo, Bitcoin nonetheless remains a controversial invention, as do the many cryptocurrencies that followed in its wake.

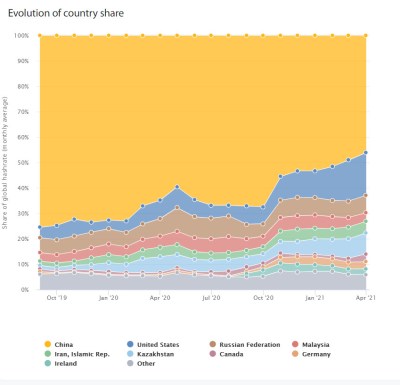

Recently, the Chinese government has cracked down on operations within the country. With China hosting the world’s largest fraction of Bitcoin mining capability, it’s sent shockwaves through the network and had a huge effect in a multitude of ways. Here’s what’s going down.

Chinese officials instructed miners in the Sichuan region and elsewhere to shut down, while also ordering local authorities to cut off power supplies to mining operations. Banks have also been instructed to close accounts or otherwise halt transactions suspected to be related to cryptocurrency operations. With the ability to strike out and make decisions in a way not typically possible in most democracies, the move has been swift and decisive.

Whispers of the political winds changing around Bitcoin had slowed investment in additional capacity for Chinese miners for some time. Prior to the move, Chinese mining operations accounted for anywhere from 60-75.5% of the global Bitcoin hashrate. According to the Cambridge Bitcoin Energy Consumption Index (CBECI), however, the number quickly sunk down to just 46%.

With many huge mining operations going offline, the power consumption of the Bitcoin network has dropped significantly. Earlier this year, there was much ado made around the fact that Bitcoin was now using more energy than the state of Argentina. We crunched the numbers and found it to be a sound analysis, and a particularly concerning one from an environmental perspective. At the time, Bitcoin was using roughly 15 GW around the clock, for an estimated annual consumption of around 129 TWh over a full year. However, as it stands at the time of writing, CBECI now measures Bitcoin as using just 11.92 GW for an estimated annual consumption of 87.3 TWh which has rebounded from a low near 10 GW earlier this month.

It’s a huge drop, and indicative of just how much mining capacity has gone offline. That has flow-on effects for the operation of the Bitcoin network, too. With less miners hashing, it takes miners longer to find solutions to solve Bitcoin blocks. The difficulty of mining is automatically changed by the Bitcoin algorithm every 2,016 blocks, based on current hashrates, in order to maintain a block solving time of approximately 10 minutes. In normal conditions this happens roughly every two weeks. However, with the huge sudden drop from the loss of Chinese miners, block solving times blew out to 14-19 minutes long until the algorithm ran a correction on July 3. Mining difficulty became 28% easier, a historically large drop for the cryptocurrency.

It’s good news for current miners, who will be sharing the spoils of their efforts with a significantly smaller pool of participants. That should last at least until Chinese operations get up and running in other jurisdictions (which may help explain the August uptick). You’ve probably never been to Kazakhstan, as the country does not prioritize tourism and thus has a poor infrastructure to enable it. However, it’s next door to China and has cheap electricity, so has seen many miners moving their operations there. The United States is also a popular choice for its lack of any organized political opposition to Bitcoin, cheap power, and ease of doing business.

The drop in energy use from 15 GW down to 10 GW was significant, marking a 33% drop. At its lowest recent point, instantaneous consumption had dropped even lower, to roughly 50% of the peak figure. If we take the current number though, we can run some calculations on the effect on emissions. The US Energy Information Administration quotes a figure of roughly 0.92 lbs of CO2 emissions per kWh of energy generated in the USA in 2019. Using that as a ballpark figure, China’s move eliminated 18 million metric tons of CO2 emissions in just a few short weeks. That’s roughly equivalent to taking 3.9 million cars off the road, according to an EPA calculator.

Obviously, switching off Bitcoin altogether would make a huge environmental saving. It would also be theoretically far easier than other efforts such as installing renewable energy sources, switching to cleaner transport, or reducing pollution from major industries. Arguments that mining operations could run on renewable energy ignore the fact that the very energy used to power their mining operations is energy that can’t be used by other users.

Of course, outside of China, it’s not as simple as the government sending a stern letter, and so it’s likely Bitcoin will continue to pollute significantly well into the future. Established, high-wealth players will fight tooth and nail against any force that could harm their investments, after all. Perhaps the biggest danger to the value and profile of Bitcoin, however, is the mere suggestion of government regulation or outright bans. Prices have dropped on the order of 30% from this year’s earlier all time highs, but have recovered strongly as hashrates climb back up and mining operations restablish themselves abroad. We suspect that Bitcoin will achieve much greater heights-and notoriety- before all is said and done.

There is such cool things going on with tokenomics. Lots of people with big ideas about how to make the world a fairer place. We are on track for AI agents catering to our needs. Now is a good time to have another look at Haskell BTW. ;)

It has nothing to do with that and everything to do with personal enrichment at the cost of destroying the ecology. The problem is that you don’t see what’s staring you in the face.

“Whatever it takes” is needed to get rid of central banks and corrupt politicians.

Raising children properly?

Sociopathy is mostly genetic, monsters will be monsters regardless of how woke their childhood is.

Being woke and instilling morals are vastly different. I agree with Ostracus.

Even if that means destroying the ecology?

Not to forget it’s not destroying central banks … just replacing it with other equivalents. Bitcoin is mainly controlled by very few. So it’s still controlled by “the 1%” … just another “1%” …

100% this ^^^

Trading one monopoly for another is not in the public’s best interest at all. The idea that this would work or go smoothly is pure fantasy. All that’s happened is the creation of a global casino that’s powered by FOMO and causing everyone to try and steal value from everyone else. It’s a cancer on our society that preys upon the most basic of human emotions. I wish we could uninvent it, like nuclear weapons.

I’m no fan of central banks and think the fed should be killed, but I don’t think that destroying the currency that’s used and saved by Americans and others around the world is the right way of getting the reform we need.

Never in history has a “currency” required an army of people on Twitter 24/7 talking their book. Imagine people constantly talking about getting your dollars before the value goes up and you’re left behind. Insanity. Frankly the entire thing needs to be outlawed.

nuclear weapons are good. world wars would have continued unending if a few select countries did not have the ability to vaporize trouble makers and those that support them. crypto is also good. sometimes i question how much energy gets spent driving armored cars around, running banking datacenters, printing currency, etc. the number of man hours that money takes up is huge. its going to consume energy no matter what.

what makes crypto good is that it enables me to subsist in a world that clearly does not want me in it. i don’t have to do a rich man’s work for him for money that they then try to con out of you by convincing you that you need things you don’t. its the same kind of empowerment you get from starting your own business, without possessing the innate traits one needs to be successful at it. its the perfect turn key for introverts. some back of the napkin math seems to indicate i can make 3x the minimum wage and still use less energy than the daily commute to what are essentially fake jobs that dont create any value (im convinced its mostly to waste your time and energy to prevent you from overthrowing the powers that be). most importantly its obtainable because i only need an 8 fold increase in my current hash power to make minimum wage.

now bitcoin, imho, was intended to be experimental, and i think the experiment has run its course. the major flaws in the system have been identified and alternate currencies have been created to help resolve them. we need to get off of the bitcoin and onto the alternatives, and soon. its just that people who hold btc wealth want to keep the system around and have the power to do so. however when the system stops producing coins, miners lose their incentive and the network will simply collapse from there. its a bubble waiting to burst.

i also think crypto came at the wrong time, perhaps 20 to 50 years too early. perhaps if nuclear power was more ubiquitous, or if we were in a post fusion world, or if renewables were more broadly established. then i think crypto would be a better fit. that world is coming and its good that all the bugs are worked out before that happens.

Want to get rid of your involvement with central banks go do the life in the countryside trade what you have for what you need routine (perhaps backed up by ‘real’ money).

Corrupt politicians will always be a fact of life, those with influence and power are always going to use them, and even with the best ‘moral fibre’ a human is capable of can be considered as corrupt – you can only make your decisions on what you see and hear, folks with lots of money and power themselves can to some extent control what is seen and heard, so even if you are an absolute paragon of virtue in a position of influence your decision is likely shaped by others with vested interests…

Then there are folks who are lacking any virtue and only in it for themselves anyway, any everyone inbetween who can’t see the harm in one little backhander on a decision they were always going to make that way…

Corrupt politicians are pretty much undefensible, but central banks have provided a ton of value and stability to economic systems. It’s strange for me to see them both in the same sentence.

There was that Bitcoin crash last year, for instance. If it were a serious currency, there would be serious repercussions of such volatility — like people not being able to eat and so on. That’s one of the reasons that central banks manage currencies — to keep them running smoothly.

Bitcoin is interesting, but a good part of its value derives from it not actually being a currency, ironically. It’s a speculative vehicle, like gold or wheat futures. If it were to replace any national currency, it would _need_ to be regulated by a Fed-like agency because people’s lives, and nations’ tax revenues, would rely on it.

This.

+1

Agree 100%. If you think inflation is bad wait until you see deflation.

You don’t because central banks can easily prevent that when not beholden to an amount of shiny metal.

So everyone’s worried about mining declines. Econ 101 when currency inyroduction reduces, deflation which is good for investors?

I just want new graphics cards to not be a myth, like dry land.

This so fucking much this. I want my 3080 not to cost me well $3080

Nvidia made new cards useless for mining with some hardware, firmware and software trickery. When the card detects mining attempt, it drops performance to 50%. In my opinion it’s not enough. I would do it like this:

1. On first mining attempt there is warning “Stop that, or else!” and after few seconds computer resets. A small fuse bit in GPU is burned out.

2. On the second attempt this repeats, but this time with “This is the last warning!”.

3. On third attempt when all three fuse-bits are burned, the controller increases all the voltages to the max, while overclocking everything and stopping fans. The goal is to physically destroy the card.

And warranty doesn’t cover this…

“3. On third attempt when all three fuse-bits are burned, the controller increases all the voltages to the max, while overclocking everything and stopping fans.”

Source? That would be extremely illegal where I live.

Oh, I’ve missed the ” I would do it like this”, my bad. Still, they can’t do that.

No, this is wrong. Destroying a gpu, when they are scarce, is bad.

All this *coins relies on exact numbers down to every bit. So if the card would randomly flip a bit, when they detect mining, it would rendered them totally useless for mining. And good luck in debuging it 😁

Or what about limit mining to one card per machine and only if there’s at least 8 PCIe lanes connected as well as a CPU with at least 4 cores? Won’t interfere with gamers wanting to do some mining on the side, but it would make it far less economic to try to build a cluster of mining GPUs if you had to have a separate motherboard and CPU for each one.

It’s complicated, prone to errors, someone could find a way to circumvent it.

Instead, if the gpu utilization is over 60%, flip a random bit. In games, you won’t even notice. For a 1/60 second, a random green pixel is going to be a little greener, and a blue one little darker. So what? You can’t even register it.

But boy, if your hashes are going to be wrong for one bit each, when you submit them, you ain’t gona earn a measly cent. Or got thrown out of pool for cheating.

People also use GPUs for accelerating all kinds of general purpose math, and you don’t want errors in that.

just mine with your old card(s) until you can get enough to pay off the scalpers.

I am kind of annoyed that this is written like we should be happy with a government cracking down on bitcoin.

Although the environmental issues are definitely important issues, the problems with payment providers being able to arbitrarily shut down whatever company they don’t like to work with, is also incredibly important.

There has to be a more distributed way of processing payments, that does not force completely legal but ‘unwanted’ workers to be screwed over again and again.

So before cheering on the demise of bitcoin, perhaps first propose an alternative to the central banking systems as we know it.

Not the only one.

Seems like a rather authoritarian take to look at China and say essentially ‘to bad other countries can’t take swift and decisive action’.

There’s lots of good reasons for a government not to have that level of power; just look at some of the less appealing ‘swift and decisive actions’ that China has taken over the last few years.

There is a huge difference between saying ‘The Rules’ are different in China, which they are, and implying that is a good/bad etc thing. All this article points out is that they are different, and as a result of that level of power this change was possible with this immediate effect to the rest of the world. Doesn’t even go in to the reasoning the Chinese might have in doing such a crack down, leaving all that politics and assumption out of it and just sticking with the technical side.

So I think it a well written piece, pointing out the economics of Bitcoin, how the social and political structure of China enabled such forced changes that really reveal quite alot of details on the global state of Bitcoin miners – One of the best insights into such an amorphous things structure and function is when something forces a big change to it and you can see the ripple – I’m surprised personally that there wasn’t an even greater dip in hashing rate, I thought more of the miners were in the cheap’n’dirty power central that is China, not like you have to actually live there to profit from setting your rig up there (though I expect some local help would make it much easier)…

Sadly Bitcoin and most/all(?) Other block chains are fundamentally incapable of managing the bulk of the worlds transactions. Bitcoin would need to process 1000x as many transactions per day, which would cause the block chain size to skyrocket. At which point, the only ones able to actually mine it would be large corporations such as banks and payment processors (and we’re back to where it all began).

Also, if I want to buy from a vending machine, I want the transaction to take less than a minute. Vending machine operators want to ensure that I can’t double spend. Those are conflicting goals within the way Bitcoin is implemented.

Also, the more value ($) there is in the Bitcoin network, the more power will be spent mining it, which means this environmental problem will only get worse.

Bitcoin has many uses, but replacing banks and CCs is not one of those uses.

1: Wrong. Lightning network and other 2nd layer solutions allow fast, low, fee transactions without the network bogging down. Other cryptocurrencies, like ALGO, can process over 1,000 tps. Algo aims to get to 46k in 2021. It takes about 2.5 seconds per transaction, much like Bitcoin’s faster lightning network. EOS can process thousands of transactions per second already, so they ARE fundamentally as capable of handling the world’s transactions as VISA and the existing financial system.

2: Again, lighting network, EOS, ALGO, ADA, etc.

3: The more value there is in the existing system, the more power will be spent running it. FYI: It dwarf’s BTC’s impact, as like 50%+ is from renewables and otherwise wasted energy.

4: It’s already replaced banks and CCs for many of us. By the time you realize what money is, and the power of stateless currency, by and for the people, you’re likely to be stuck begging Jeff Bezos, or the government, or Facebook, or VISA for some BTC, or some of their own centralized currency.

“Many” = <1%

Actually the other way around as if this fad of bit coining gets to ‘x’ level of use, the government will take notice and want it’s pound of flesh and pass legislation to regulate it as a ‘real’ currency or just legislate it out of existence. You know income ‘taxes’ and such. Plus then you must contend with the ‘value’ of things. Right now you can say bit-coin is worth ‘x’ dollars, so you can ‘buy’ a product with whatever perceived bitcoin is worth against that currency. That is why eventually it would need an oversight organization (central bank/government of some sort?) to manage and stabilize it. Then you need some way to handle hard currency aspect… Now your back where you started with oversight organizations . No Bitcoin isn’t the salvation of the monetary system. Nothing there to ‘back it’. Reminds me of back when each bank had it’s own currency backed only by that bank. Didn’t work so well… Anyway, It will just make it worse in the long run plus ironically consuming copious amounts of energy to get anything done (beside the fact you need a computer to do ‘any’ transactions). Right now I can pull out a $20 bill and go buy lunch. No password needed to dig it out of my wallet. That system works really well. So it seems like there is always someone wanting something for nothing (get rich schemes)… “Why all I got to do is mine for coin, and the money just flows in to my virtual wallet”…. zzzz.

Cryto-currency as an efficient converter of electricity to micro-value (HaD can ditch any ads and go micro-transaction). Cut down on the number of “waaah, another paywall” while maintaining the illusion nothing was exchanged (stop looking behind that curtain). No ad-blockers died in the making of this post.

“Cryto-currency as an efficient converter of electricity to micro-value”

It isn’t efficient, though.

Are you serious about that part when you say that bitcoin has replaced payment processors “for many of us”?

The way the bitcoin is (wrongly) set up at the very beginning makes it look and feel much more closer to commodity instead of currency. There is no change in processing speed good enough that will make it attractive for a regular Joe to make him use it in every day life as payment tool/mean.

While I am all for replacing the current monopoly that payment processors and certain govts have on how money moves over the globe, the bitcoin is not even close to a real contender for this replacement role.

“Arguments that mining operations could run on renewable energy ignore the fact that the very energy used to power their mining operations is energy that can’t be used by other users.”

Whut? The same is true of electric cars, ovens, HVAC….

All of these things are actually useful. Bitcoin wastes energy for no purpose.

Exactly! Folk still need transport, cooking, lights – that energy cost is producing useful work, but there is nothing useful produced at all by Bitcoin’s energy consumption – I mean if it was distributed useful computing power that would be one thing, but it is just creating waste heat calculating nothing of any use.

If you don’t see securing stateless currency as useful work, then you probably shouldn’t be trusted with finances ever.

The electric cost of bitcoin has almost no relation to the actual functioning of its transaction mechanism… Its full of make work that does nothing useful. Other cryto does it better on that score, some of them maybe even have as much legitimacy to really count as a currency rather than an investment lottery..

Plus ‘stateless’ currency has always been a thing, basic barter trading with no fixed units at all, your plain basic precious rocks and metals, the whole concept of an IOU etc.

Even using money that isn’t ‘stateless’ as stateless currency happens in the real world all the time – the US dollar (counterfeit or otherwise) has a varied value in real world terms in many places across the globe with no state involved, the people of that region see it as a useful token of value, so it is, no matter what the rest of the world thinks the current exchange rate, economic state of the USA, the supposed value is, it has a loosely agreed value to that community.

It isn’t a currency. Essentially nobody uses it as such, because it’s terrible as a currency. It’s a commodity, like Beanie Babies.

I have always thought that if there was a monetary reward for solving useful computational problems like protein folding or DNA mapping then you would have a win-win situation. How about a compute grid that corporations could use and reward the owners in the form of a crypto currency. Doesnt save energy but at least you are computing something of value.

i always postulated a crypto currency doing particle physics stuff for fusion research. idk how that would work, but it would help solve the environmental problems of cryptocurrencies (and everything else) in the long run.

That would be Curecoin/Foldingcoin. Also, a year or two before Bitcoin, there was an attempt at a PC app which let others use your PC for computation in exchange for giving you access to free, legal music, but that failed because at the time, there was little demand for computation without data security.

For some BOINC projects, there’s Gridcoin

“no purpose” tell that to someone in a third world country. And if you’re retort is “eth 2.0, proof of stake!”, well that just keeps the rich in positions of power.

Energy is purposeful if the user sees economic value in it. It’s entirely subjective. If there are harms caused to others, well then that’s a matter for courts and lawmakers. Bitcoin could easily be run using a small fraction of the energy wasted by industry, and energy gets cleaner and cheaper as time moves forward, so your entire argument becomes much weaker as time moves forward.

How is bitcoin any different from other cryptos? If anything its worse, as to really make money in bitcoin you need to already be pretty damn wealthy to afford the equipment that will let you earn more.. Those already fortunate financially are pretty much always at an advantage great enough to remain there – have to be a pretty stupid rich person, or up against cunning cheaters and criminals or real stock market reading genius types with a vengeful streak towards you to actually come off enough worse to not stay in that position…

Energy may get significantly cleaner and cheaper, that isn’t a really certainty, being tied to demand and production capacity of cleaner power facilities – can only build them so fast, they can only generate so much. But as demand gets ever bigger – which ‘profitable’ but pointless garbage like Bitcoin contributes too rather significantly, then the cost and cleanliness doesn’t improve near as much as it could/should have done, if it improves at all.

That argument is basically saying my car does 5mpg more than my Dad’s did, so I should burn a few hundred extra gallons a year in an oil barrel miles from anywhere (the point being it is for no purpose) to make up for it..

How is Twitter different than this comments section? Oh, that’s right, Twitter is valued in the tens of billions and used by almost every public figure to communicate to vast numbers of people. Look up Metcalfe’s Law. The benefit of using other cryptos doesn’t outweigh the cost of switching from a network the size of bitcoin. Anyone can invest in a mining company if they want more than the actual coin deflation. Not everyone has the wealth required to collect ethereum 2.0 validation fees though. Bitcoin incentivizes clean, sustainable energy. Many renewable power plants can sell their excess power now.

At the moment we really don’t want to be wasting the renewable oversupply spikes on pointless make work – as we have far to little clean energy production to meet the demands and a powerful need to make energy cleaner… Which is why so many energy storage companies and sites are turning up as well as more clean energy going in. Maybe in 20-30 years when the basic needs can be stably met in a clean fashion and there are still oversupply spikes it can be justified to burn it so pointlessly, but now if you want to make money, spend your fortune invesnting in hardware and not be a douche to the enviroment investing in energy storage to buy cheap green oversupply and sell back ‘expensive’ is just so much better for everyone.

Bitcoin doesn’t incentivize anything but getting your hands on the most hashing power you can and putting it wherever the power is dirt cheap – doesn’t even matter if the hardware is the most energy efficient, as even very old GPU by the building full can be run for profit if the power is cheap enough…

All that hardware, and the continual electrical cost… Not everyone has the wealth to invest enough in either of those to actually turn a profit… About the only way Bitcoin mining on small scales might make sense is when its only active when you need the electric space heater and posses a computer (But you can’t afford to or are not allowed to fit better heating to your home) – you might just earn back a tiny bit of the electricity cost you were spending anyway to not freeze…

Just because Bitcoin is a little large means nothing, its far too small still to be that hard to replace. Just compared to any of the bigger nations in the Euro zones old currency its tiny, and they all dumped their old money for Euro’s, good idea or not isn’t the issue here, just that the existing value and effort required to do so was far far vaster than turning off one computer network for another, when basically all of the bitcoin hardware will just work in the new networks, so the actual cost is just not running the bitcoin code…

I believe the Bitcoin model is inherently flawed as it simply does no actual work beyond accounting.

Turing complete-ish chains like Ethereum that can distribute computation power to actually do work sound like a winning combination to me, however.

Ha! Accounting is worthless if you can’t trust the accountant, or can’t get them to record your transaction 24/7 world-wide in an immutable fashion, barring a G7 state-backed attack which would undermine that state’s economic wellbeing.

How does Turing completeness help in that regard?

I’m going to open a bitcoin mine in Quebec (cheap hydro electricity, hey I’m savin’ the environment!) in a real mine! I’m going to use the waste heat, and some grow lights, to grow legal pot.

i like the way you think.

Would you be interested in hearing about my IPO? :)

Before this year’s cryptocurrency boom, I joked that crypto mining is good for people that use electric heating in their houses, because they can have some of the electricity refunded

im alaskan so it works for me. probibly not as efficient as the heat pump, but it does enable me to buy things without having a real job. also in the us its not counted as taxable income unless you directly exchange it for usd.

Cryptocurrencies, like cryptides, gods and toothfairy are made up. Bitcoin, and any -coin is a digital tulip scam. Comparing cryptocurrencies to normal currencies shows only, how ignorant is anyone making such a comparison. Normal currencies are long-term stable and their values are determined strictly by the rules of economics. Their value is strictly determined and controlled by governments (for the most part), and supply and demand for the physical things keeps them grounded in reality,. Even when value of US dollar was based on gold, the value of that gold was based on amount of gold owned by different countries, both as stored metal and unprocessed gold ore.

Value of any cryptocurrency is fake. It’s based on supply and demand. And if demand is low, value is low, too. That’s why there are hundreds of -coins that are worthless, while lucky few grow in value for being fashionable. The only real value they all have is how much energy is wasted to “mine” them. And “mining” them creates nothing. No useful information that could benefit human kind. They waste computational power to solve problems that doesn’t matter for the benefit of no one.

So any sane person should “mine” 100 of any new cryptocurrency as soon as it appears, and sell it when its value is pumped up by morons who doesn’t understand basic economics. Exchange these worthless bytes for gold, as gold always increases in value in the long run…

There is nothing fake about a stateless medium of exchange, that is secured by a distributed consensus. Distributed ledgers are no more “made up” than a bar tab ledger, only it is not centralized and subject to the corruption of a solitary individual. It’s value is very real, and those who deny this, do so at their peril. Anyone who doesn’t understand this stateless currency is part of a revolutionary monetary system, will be destined to polish the shoes of those who do understand this simple reality.

And I’m sure all the communists of those early heady years thought the same, really didn’t work out well for them in the Soviet Block…

Human life is never that easy or certain – just because its not supposed to be subject to corruption doesn’t mean it really isn’t – and in something more distributed a cunning bad actor can hide in the crowd – where everyone is watching their bank manager, politician etc as they know who to watch (though being able to nail their arse to wall when they get caught is another matter).

All fiscal value is made up – a ‘real’ currency can only buy what the seller thinks its worth to them, which is based on what they think they can then buy with it – its all just a shared delusion, surrounded by a framework that makes the transactions convenient. I’m not going to sell you my loaf of bread for £1 or even a million if I don’t think the mill/farmer will sell me the ingredients to make more, with some recompense for my time in making it – which in the case of GBP, USD, Euro’s or any of the other more stable currencies I most likely do believe – unless there is some current affairs reason to doubt it going forward.

>which is based on what they think they can then buy with it

The way fiat currencies are created, there will always be someone who needs the money because they have a debt to pay in that currency. There is no money without such an obligation, because the moment the fundamental debt is paid off, the money disappears.

So while it’s correct to say that the value is based on what people think they can buy with it, this is no delusion: one thing you can always buy with the money is a release from the contract of debt that created it, and this is what forces the money to have value.

It’s quite simple really: A creates money by writing a big I-Owe-You and deposits it in a central bank. The central bank prints them a matching number of bills. Other people then accept these bills because they know that A will be severely punished by law if they didn’t accept the bills back in payment.

Usually it’s nation states that take on the initial debt to create money, and this is why states “never pay back” – they simply keep re-issuing bonds to replace the ones that expire. By taking on more debt, they issue more money, and by paying off debt they recall the money out of circulation, thus controlling the amount.

Except you can’t force it to have value beyond its material usefulness – its all based on the belief that the stated value of such things will be honoured, that debt is somehow actually tangible and real – so it only has value when everyone agrees it actually has value.

When/If Society at large decides the USD is worthless it is no matter what the printed paper says – there is no stockpile of real physical material value that backs it up, and even if there were you are making the assumption you will actually get that exchange, which you won’t at the rate you expect if everyone has decided the currency is worthless – the whole thing is just a societal belief because of the convenience having more universal trading tokens creates.

Just look at the 2008 financial crash – absolutely nothing changed in produced products, useful work etc – the actual ‘value’ of the World doesn’t change, just the house of daft money screwed up so everyone suddenly doesn’t believe that 20 is worth today what it was yesterday…

> that debt is somehow actually tangible and real

When the IRS comes after you for failing to pay your taxes, and your debtors start repossessing your stuff, the debt becomes very tangible and real.

To make dollars worthless, the entire society should suddenly up and decide to rip all financial contracts and declare all debts null and void. You think that would happen?

> absolutely nothing changed

The 2008 crisis was long in the making, and it was created decades earlier by giving out credit as welfare to people with no means to pay it back. These people then bought houses at marked up rates and created the housing bubble, which lead to more lending against non-existing value and market speculation. A bunch of people knew it, and hid it to the best of their ability to profit off of the situation. It took until 2008 for the big S to hit the big fan.

In other words, the government printed a bunch of extra money without anyone noticing, and when it came up the economy went, “Hey! We have more money than economy – the prices are all wrong!”. Then the government bailed a bunch of corporations out, which meant giving them that extra money.

To say “nothing happened” is just obtuse, like setting your own pants on fire and going, “Weird, why is it suddenly getting warm in here? Must be the pants!”

Doesn’t take the whole of society at all @Dude, just some chaos to seep in so enough folk loose trust in it, which will spiral, at which point that wheelbarrow of cash can’t buy a loaf of bread… Sure that technically still counts as having value as the third wheelbarrow probably gets you the loaf, but it is basically meaningless..

And during the build up and crash nothing at all changed, folks went to work, the same output was created, the actual value in the system never changed. The crash and its knock on effects are very much human reactions to a basically fictional event, those tokens could have just kept on being used at much the same value as before if people accepted that is what they are worth, that the houses, cars etc they bought haven’t changed. Accept that and the house of cards that fell over becomes entirely a fiction, a few folks made bad deals and loose out but the massive collapse doesn’t really happen.

Its that everyone got antsy and so much faith in ‘the system’ was lost that causes the trouble. Money stops changing hands as easily, you don’t go buying even something as normal and required as new clothes when you don’t know if you will be employed tomorrow, which ironically means many people won’t stay employed, as no tokens are being spent at your employer, so they can’t give you any… Along with so much grabbing to claim the biggest share of the ‘good numbers’ as the world burns rather than treating it all as business as normal that gets companies to collapse, banks to run out of cash etc… And that is what leads to the money becoming worthless, as suddenly the value of the world dropped, people stopped creating…

> the actual value in the system never changed.

Yes, but the amount of money did – and what should you do with that? If your accounting doesn’t keep track of reality because huge corporations are hiding information, and large amounts of people make contracts they never could or would keep, then market crashes are inevitable with any monetary system.

However, we didn’t go Zimbabwe in the 2008 crash – the stock market went down 10-20% and then recovered, and one of the interesting results of the crisis was that it didn’t so much affect the very poor but the very rich who had investments that went south. That’s why there was so much talk and hair pulling about it: bubble money went bye bye and a lot of gamblers lost their bets.

> those tokens could have just kept on being used at much the same value as before if people accepted that is what they are worth

This is basically what the government did with the bailouts: they printed more money to buy the bad debt and convert it to state debt instead of corporate or individual debt. The result was inflation exactly because every time you add more tokens to the game, people increase prices automatically.

To keep pretending that money was still worth the same despite actually having more money in the books would be impossible, because it would mean that some people are allowed to have and use “false money” that isn’t accounted for. That would be truly magic money.

Kinda like in the Soviet Union where bread always cost 30 cents a loaf because the prices were fixed, so the actual purchasing power of money varied depending on the product you were buying. Pretending that money was always worth the same prevented the economy from adjusting prices according to marginal cost of production, which made it open to all sorts of abuse.

This is such a delusional take. If you think for one second that millions of people will be OK with getting wiped out financially and then “polish the shoes” of these new bitcoin elite, you really are out of your mind. There will be war and trust me buddy, you’ll have a huge target on your back. Won’t that be a fun world to live in? Bitcoin is nothing but a cancer on society that’s going to cause the end of civilization as we know it if it “works”.

In 2010 one BTC was worth 0,09USD. In 2017 it was worth 997,69USD, in 2018 it was worth 13412,44USD. In 2019 it dropped in price to 3869,47USD. Now it’s worth 49021,70USD. How could anyone trust a fake currency that changes so much in value over such a short period of time?! And what happens when a major cryptocurrency exchange “accidentally” loses all its data? Which happened here, in my country some years ago, and many idiots who invested in that fake money, lost it. The greatest feature of cryptocurrency, the crypto- part, let the owners of that exchange steal all the fake money they were entrusted with, and no one can get it back…

This feature also made cryptocurrencies a favorite tool for the criminals. Like TOR, it is used more often than not for nefarious purposes and protects drug dealers, pedophiles, thieves, weapons dealers and other “nice people” like that. It also encourages other crimes: recently there was a case of major smuggling operation in South Korea. Criminals were stealing and smuggling graphics cards for miners…

A ledger in itself is simply worthless if there is no obligation or consequence to breaking the contract that made the money. In other words, if I give you a token for something, I don’t have to accept that same token back in payment if I don’t want to.

With BTC there is no contract – the tokens merely exist. The fact that there is a shared consensus about who they belong to does not make them valuable or indeed money at all.

People who think that cryptocurrencies are basically fictional need to check that perception against what makes fiat currencies valid. Fiats are controlled at the whim of political operators as much as economic factors. Other than their longer histories, fiats are pretty much equally fictional. They all depend on a consensus of value.

Some newer crypto’s are built to prevent unlimited printing of new currency (unlike fiats) and are instead deflationary, where supply drops over time. These change the economic game and encourage longer-term holding vs the flashy “to the moon!!” pump & dumps.

For those with environmental concerns (valid), the market is already coming up with solutions. Look at “Proof of Stake” validation vs the “Proof of Work” method used by Bitcoin.

Remember, we’ve been using fiats for thousands of years and crypto’s have only been around for a little more than ten. What you see today are only the “Model T’s” of crypto. If you factor in Moore’s Law, the long term issues mostly disappear.

Crypto’s have the potential to disintermediate the finance infrastructure much like the Internet disintermediated publishing.

Instead of putting my money in a bank for a small, savings interest rate and having the bank make money by lending it to others at a higher lending rate, how about we cut out the middleman and I’ll lend it directly to the borrower at the bank’s rate? This kind of distributed finance is coming but it will likely piss off traditional financial stakeholders along the way.

“If you factor in Moore’s law” … which hasn’t held for some time now.

The thing with lending your own money is you are the only person who looses if the client can’t pay…

With a large industry making their money lending out their other clients money it would take really daft lending practices to actually loose out, in the same way insurance companies pretty much always make stonking profits – even though that payout or this seems huge they get to take a little from so many that the odd rather large insurance settlement is basically meaningless pocket change…

I really don’t see bitcoin type stuff making any real difference to the fictional world of money trading, its all pretty much bollocks anyway.

Here is the issue. To get real fiat currency like dollars, peope do useful work. Be it physical labor or by investing their dollars in stocks, bonds or other securities that fund venture that actually do something useful. Most cryptocurrency is based on solving a mathmatical problem that no one cares about the answer to. Its like asking for dollars because you dug a hole and filled it back in. Effort does not equal reward, useful output equals reward.

Most people get bitcoin in return for regular useful work. I’ve done a few jobs that got paid in bitcoin, for example. Mining only represents a small sliver of the whole bitcoin infrastructure, but even that is useful work because miners help to keep the network secure.

The amount of effort to mine a new coin is similar to the amount of effort to buy one on the market. That’s by design, because it allows growing the supply without counterfeiting.

This!

And supply and demand of real currency doesn’t affect much its value, because the stability of that value is ensured by governments and financial institutions. When government starts to mess up with its own currency, it ends up like Zimbabwe, where everyone earns billions of dollars on a daily basis. Still that money is worth more than BTC – you can wipe your butt with billion-dollar bills…

“Like asking for dollars because you dug a hole”

You know how we get gold out of the ground, right? The backing store for the “worth’ of most currency until recently. And it didn’t have value except for the fact it was rare, didn’t tarnish, couldn’t be faked, and perhaps most importantly did not have an issuing authority. Rare because it was hard to get, but also in a sense available to all…

Bitcoin has all these properties designed into it. That makes it a useful token of worth. Sure, you can make a golden ring or tiarra or whatever, but at the end of the day that just makes it easy to carry around. Until recently gold was not a consumable.

Now how would you prefer to store your value? In the even-deflating dollar?

Don’t get me wrong, I’m not a ‘bitcoin maximalist”; there’s plenty of reasons to be skeptical of bitcoin, but its value as currency (pun not intended) is NOT one of them

>fiats are pretty much equally fictional

Not quite. Fiat money has an expiration date – once the bond that created it matures, the issuer of the bond has to buy the money back from the economy and pay the debt. This is why the money is valuable: there is no dollar, yen, or euro in the world that simply exists without someone being in debt for it, and that someone needs to buy the token back – which means YOU can sell it to them in exchange for something else. This is the reason why a dollar always has some value – however little or lots it may be.

Bitcoins are not money like this. There is no obligation to take them back once created, so their value is ENTIRELY fictitious.

So, bitcoin is bad for the environment. How about physical money? It needs minting/printing and shipping to banks and from banks to shops, shops to people, people to shops and shops back to banks. As well as many other convoluted routes. Most of which needs heavyweight armoured cars and men with security gear, counting machines, safes, etc etc etc.

There’s about 7 large buildings in my small town dedicated to banks. Bitcoin doesn’t need them, just one big factory out of town somewhere with convenient cooling water flow.

Is a crypto currency really worse than all that??

Yes. It doesn’t require GW continuously to distribute physical cash. And you know what? The vast majority of traditional fiat currencies are not moved as physical cash – especially since COVID moved everyone to using contactless – which makes your whole argument pretty pointless.

VISA etc are vastly more eco-friendly than crypto currencies.

If energy costs were as big of a factor in banking as it is in Bitcoin you’d see energy cost fluctuations cited as a risk factor in bank annual reports, and you’d see banks making an effort to move their facilities to places with particularly cheap energy, the way bitcoin miners do.

We don’t see this happening.

for those unwilling to fact check:

https://www.nasdaq.com/articles/research%3A-bitcoin-consumes-less-than-half-the-energy-of-the-banking-or-gold-industries

right now banking uses more than double. of course you need to account for market share. that said bitcoin is only a prototype. it has bugs to work out, hence the multitudes of alternative currencies.

Gold is the fundament of all fiats.

Is gold mining bad for the ecology?

Maybe we should stop?

You cannot be seriously comparing the intrinsic value of the USD$ to any of the digital currencies. Look up “full faith and credit”.

There is no intrinsic value of Bitcoin units, nor any other digital currency. They lack the primary requirements of any useful medium of exchange: 1) fungibity – the ability to spend the currency on any item or service; and 2) stability – knowing that a loaf of bread will cost the same, week after week, with only minor variations.

When I see posts like yours, it reminds me of stock ‘pumping’, where nearly worthless stocks are inflated so that the suckers can buy them before the ‘pumpers’ dump the stock and crash the value. All the hand waving arguments about how wonderful Bitcoin is as a currency/medium of exchange don’t mean much until it can be shown that it or any other medium of exchange meets the basic tests for a currency.

Now, it you want to claim that Bitcoin is an investment, I might accept that argument. Then it becomes a question as to the current value and future prospects for increases in value. In my view BItcoin is a Ponzi scheme that will eventually become worthless. Unlike companies that make a possibly useful product or service, Bitcoin delivers nothing and is simply an entry on a complicated ledger. Just like tulip bulbs, it looks pretty but has no lasting utility or value.

Value of any currency is based on people being willing to provide something tangible or exert effort to obtain it. People will work for dollars because people see that they are valuable. If people doubt the viability of a currency or its future value, it becomes less valued. The dollar is strong because most people believe in the near term survival of the US economy, nothing more. The currency of Afghanistan would have less value because people are in doubt about its government’s stability in the near term. Not a political statement just how fiat currency works.

This is all relative. Its not that the US and GB governments are not going to have issues, its just that they are considered to be more stable than other choices. Bitcoin just got threatened by the fact that this “nationless” currency just got thrown into turmoil due to a policy decree by a nation. It is not and cannot be independent of national policies because its production can be controlled and its holding can be taxed. Any nation that wants to can declare it as illegal tender, which would not eliminate it completely but would force it out of regulated transactions. No currency form os free from government control as long as people are under government control.

The reason why dollars carry value is because they’re created as credit: the contractual obligation to pay back the debt means SOMEONE has to buy the dollars back, which means other people can always get something for them.

In this instance, since dollars are created by the government issuing bonds, which the banks then use to expand the money supply through fractional reserve banking, the value of the dollar ultimately goes back to the need of the government and all the people who took loans in dollars, to buy the dollars back.

It’s not any “belief” in the money, but the contractual obligation to pay in kind that forces people to provide something tangible for the money. As long as they respect the contract, as long as the state or the system of law in the country makes you respect the contract at the pain of punishment, people have to treat dollars as money.

Nobody and nothing forces people to treat bitcoin as money like this, so it simply isn’t money.

That’s why bitcoin isn’t worth nearly as much as the USD$, or even gold. Fungibility is better than physical gold, and stability will improve over time.

“no lasting utility value” – cryptocurrencies such as Ethereum can be used for smart contracts, so they have a bit more utility than Bitcoin

Current currencies also don’t fulfill the stability requirement, because they have inflation.

Change itself is not a problem. Stable inflation is predictable, and it is maintained deliberately at a level to keep the economy from flip-flopping randomly between inflation and deflation.

More like < 0.001%. 8E9 population * 1E-5 = 8E4 (80,000), which is likely far more than really use BTC and all of the others on a daily basis.

This is really about shills trying to convince suckers that the suckers should buy the shiny new, but practically worthless, BTCs. While there might come a time where physical currency is no longer widely used for non-criminal transactions, the currencies being used in the distant future won't include BTC or any of the so-called crypto currencies being promoted today. There are too many reasons why people cannot trust them to have a stable value.

However, if BTC is used a lot by criminals, and let’s assume that is 10% of any given economy, then that’s a lot of demand for actual transactions flowing through the BTC ‘banking’ system.

On that basis alone, it would seem it isn’t going away in a hurry.

“…often derided as “worthless” and “made up” by those who forget that all currencies only have value because we believe in them…”.

You could say the same about something like the Zimbabwean dollar. People don’t believe in it, so its value falls. People believe in the US dollar, and the US economy, so it remains fairly stable.

“…the world’s strongest currency not backed up by guns and ammo…”.

Guns and ammo probably have a role, but it’s also about having a stable and well functioning economy. If you can’t make enough food to feed the population, and efficiently provide all the other things they need, your currency will be worthless. Guns and ammo can’t make up for a poor economic system, at least not in the long term. Fiat currencies are all about belief, but it’s not just blind faith, it’s belief in the political and economic stability of the issuing state.

The need to pay a dollar loan back in dollars forces people to “believe” in the US dollar.

The entire point and purpose of a fiat currency is that it creates a contractual obligation to eventually return the money back to its source. All the people who are in debt HAVE to buy the money back through providing whatever service is needed to make other people give up their dollars, and as they eventually pay the primary bond that created the money, it removes that money out of circulation so there’s no worthless contract-less money left floating around.

Any token that simply exists without intrinsic value is no money at all. A BTC is not money, because it does not carry any contractual obligation and it has no intrinsic value.

“The magical internet money is often derided as “worthless” and “made up” by those who forget that all currencies only have value because we believe in them”

Bitcoin isn’t a currency. It’s useless as a currency. It’s a commodity.

Nope, not a commodity because it has no value other than as a transactional token. It is a currency. Currency only has value because it is used to obtain labor or items of physical value. Commodities on the other hand like gold, silver, corn oil, hog bellies, gasoline have a value in that they can be consumed or used to construct physical things.

When the US says the dollar is legal tender they are making a promise that you will be able to use it to transact business and pay debts in the United States. Bitcoin is only viable if people agree to accept it as payment. In the US businesses MUST accept the dollar by law. The stability and value of the dollar is enhanced by the fact that it is accepted in most major economies in exchange for goods, services, and local currency because it is fairly stable and unlikely to have enormous swings in value (which presents an investment risk to currency holders). Tesla can decide to accept or not accept Bitcoin any time they like but they have to accept dollars within the US.

The US does not make a promise that your dollars will be worth the same in 10,20 or 50 years. Having a currency that you have to accept by law while someone has the power to print more is just a recipe for abuse.

It doesn’t need to. The value of money is subject to supply and demand.

The point is that the way in which a dollar is created guarantees that it always has demand, therefore it always has some value. The contract of debt that created each dollar means someone has to buy the dollar back from you.

If you’re concerned about electricity use, don’t forget that Bitcoin isn’t the only cryptocurrency – there are others, that don’t require lots of energy to mine. For example proof of stake cryptocurrencies aren’t mined like Bitcoin.

Boohoo

Funny that in all the smoke and noise about electricity use, environmental degradation, and fiat currency, nobody’s mentioning using Bitcoin (et al.) to exfiltrate funds – even at a large loss -from behind the Iron Paywall, which has been an ongoing concern in China for several decades.

Like it or not, VaporCurrency™ is much lighter than gold and a lot easier to hide.

Hm. All of you complaining about the “monopoly” on currency… why don’t you advocate for the bartering system? You know trade goods and services for goods and services? That’s the way it’s been done since the beginning of time. While I do accept cash for my services, I also work in barter with quite a few locals. You can’t [easily] regulate barter between private individuals.

Basically its not about cryptocurrency, but about the ongoing «race» to always beat the current global Hash rate with something even higher.. Even at 7nm it was going to start pushing power use to get even higher, and at current rate consumes about 650 tons of CO2 per bitcoin (that is with the current average global power production mix).

If burning C to get CO2 and power was unfeasable, the problem would be less. Until Silicon shortages and other problems started to hit home…

Cryptocoin has to get past this to have a future. I mean, anything with an exponential development will hit the roof at some point. It needs to be balanced. Inflation does that for paper money, so maybe that’s whats missing here.

Bitcoin only has as much value as people are willing and able to pay for it. When the dollar crashes so does Bitcoin.