If you were reading this post a month ago, you could have been forgiven for thinking it was an April Fools post. But we assure you, this is no joke. A company called HeatBit has recently opened preorders for their second generation of Bitcoin miner that doubles as a space heater.

The logic goes something like this: if you’re going to be using an electric space heater anyway, which essentially generates heat by wasting a bunch of energy with a resistive element, why not replace that element with a Bitcoin miner instead? Or at least, some of the element. The specs listed for the HeatBit Mini note that the miner itself only consumes 300 watts, which is only responsible for a fraction of the device’s total heat output. Most of the thermal work is actually done by a traditional 1000 watt heater built inside the 46 cm (18 inch) tall cylindrical device.

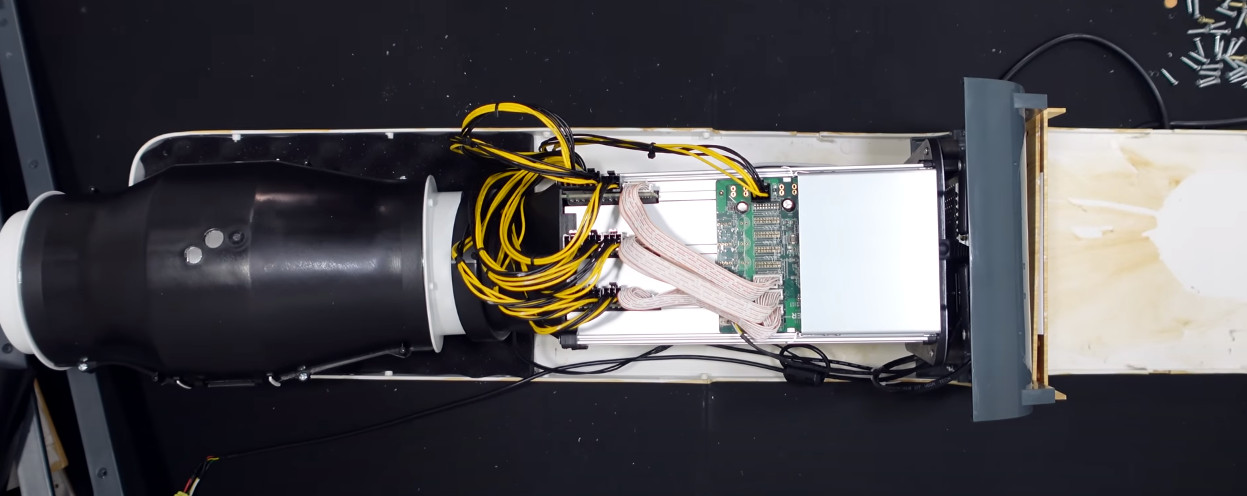

This new Mini version appears vastly different from the original HeatBit, a towering machine that combined outdated application-specific integrated circuit (ASIC) miners with a turbine-style fan to produce heat. In doing a bit of research on the older model it seems like results were very much mixed, with several reviewers complaining the last-generation ASICs used by the $1,200 heater would take far too long to mine enough crypto to pay for itself.

In comparison, the $299 Mini seems more like a traditional heater with a secondary Bitcoin mining mode. We’d say that at that price it’s probably worth giving the concept a shot, if it wasn’t for the fine print…if you purchase the Mini at this “early bird” price, HeatBit will skim off 50% of the Bitcoin your device cranks out. If you want to keep all the coins for yourself, you need to shell out for the “Full Ownership” version that has an introductory price of $549 and climbs to $749 once the heaters are available at retail.

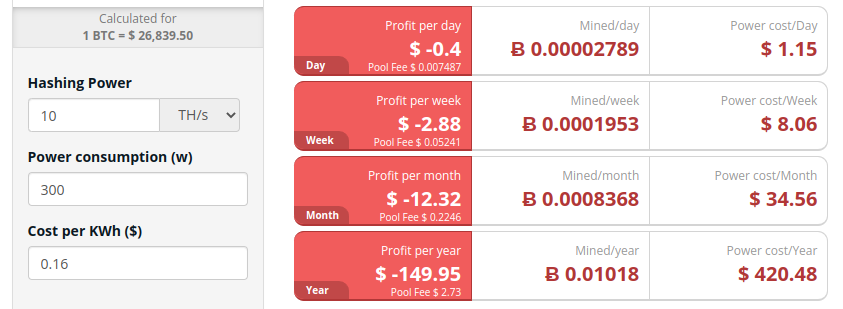

If that’s not bad enough, the specs for the Mini show a hashrate of up to 10 TH/s. We ran that through a few calculators, and combined with the stated 300 watt energy consumption, it appears the device isn’t even capable of breaking even at current BTC prices. So if you were hoping to make a profit, forget about it.

Assuming the current rate of approximately $26,800 USD to 1 BTC, the Mini would bring in about $22 a month if you ran it for 24 hours a day. But with the average electricity cost in the United States (0.16 $/kWh), it would have cost you around $35 just to power it. Factor in the 50% that HeatBit takes off the top, and the math just doesn’t work. Sure you could make the case that it’s cheaper to run than a traditional electric space heater, but the payoff for the hardware is simply too far out when you consider you’ll only be using the thing a few months out of the year to begin with.

Bottom line, if you want to try and warm your office with Bitcoin, you’d be better off picking up a second hand ASIC miner and building the thing yourself. It still wouldn’t be the money-making scheme it might seem like at first glance, but at least you wouldn’t have some company taking half your profits every month.

It might not be April, but there will be plenty of fools involved anyway…

Here in hell bring it on!

It’s nothing new. The concept has been used with the name of “Data furnace” for years:

https://en.wikipedia.org/wiki/Data_furnace

I’m also still waiting for all this cryptocurrency to fall over and be exposed as a ponzi scheme.

But there are still a lot of people who believe either “it’s too big to fail” or for some other reason.

Apart from that, when bitcoin was below EUR1 I was tempted to buy 20 or so of them “just for fun” when they were still below below EUR 1, and sometimes I regret I didn’t bother back then. But now… as far as I know their “worth” is now 1/4 of what it was at their peak.

I had thought of buying a bunch back in the early days as well (I suppose many people have a similar story), but got talked out of it. Sometimes I imagine the potentially millions of dollars they’d have been worth today, but if I’m honest with myself, there’s no chance I would have held out long enough to get a payday like that. Had I bought them at $1 USD each, I would have sold at ~$100 and called it a day.

Would have spent the rest of my life dealing with crippling depression due to my shortsighted decision, but that’s another story. Reminds me of an acquaintance who bought a pizza for something like 20 BTC back when you could still mine them on a normal desktop computer. Now that’s a guy who still has regrets.

20 btc pizza, imagine being the guy that paid 15,000 coins for a pizza.

I have a friend who got a degree in ancient Egyptian history. He got out with over $100k in debt and couldn’t find a job. So he went back, racked up more debt, got a PhD, and now he makes like $40k/year teaching Egyptian history to other suckers. Clearly a Ponzi scheme.

Everything is a Ponzi scheme. Right now we’re getting easy money from resources we can’t put back, so we need to recruit more suckers (our children and grandchildren) to invest and keep it propped up.

Please explain how, for instance, being a surgeon or a pharmacist is a Ponzi scheme?

The medical system is a huge house of cards that isn’t doing basic services properly. Need a procedure? The unaffordable ‘insurance’ you are unconstitutionally required to buy sets the prices. What are the prices? Much higher, like 100-200% more than open market cash prices. If I was going to pay cash, I couldn’t because I spent that money on the ‘insurance’.

If you are a surgeon or a pharmacist you aren’t making any of that money, and you are usually overworked.

Imagine saying in 2023 that learning and understanding history is for suckers.

Not everything, but certainly modern government entitlement programs.

“Clearly a pyramid scheme”

FTFY

Only a ponzi scheme is a ponzi scheme.

A ponzi scheme is not a generic scam (which is how it seems you’re using it). It’s a specific financial mechanism of pocketing the initial investments andusing new investors to pay old investors until paying isn’t possible due to scale.

If you haven’t looked that up, it’s doubtful you’d have checked out why bitcoin is a good store of value against currency debasement.

Maybe check out some Michael Saylor or Raul Pal, or Robert Breedlove youtube interviews.

It’s not a ponzi scheme. Bitcoin has non-zero value because it provides utility as a form of money with some unique properties. We can argue about how much that value should be, but it’s complicated because the utility is affected by the volatility. As the volatility goes down, utility goes up, and then the value should increase, which also increases the volatility. The result is a chaotic feedback system.

It has the same utility as poker chips – only, the casino is the entire world wide.

And it’s not the item that is the ponzi scheme, but the setup of the show. A ponzi scheme is an investment fraud where all the profit collected by the investors come from other investors, while the originators simply skim some off the top and never intend to produce a viable product or business as it was originally sold to the investors.

The people who made up bitcoin and other cryptocoins for that matter, were banking on printing money for themselves while recruiting outside investors to pump the value up through speculation. The claims made by Satoshi etc. never actually materialized, as Bitcoin is totally useless for trade or reserve currency, because it isn’t controlled by anyone and it carries no intrinsic value of any sort. It doesn’t even come with a debt obligation like fiat money that would ensure the party who issues it ever has to buy it back. It’s literally funny money – poker chips and monopoly notes.

Aside from food and clean water, there’s no such thing as intrinsic value.

>Bitcoin has non-zero value

Some would argue the true value estimate for bitcoin starts with a minus sign, because of how much energy it uses to facilitate what is essentially a hot potato betting game, plus some underground drug deals and other shady activity that needs pseudo-anonymous currency.

It cannot be both a hot potato betting game *and* a currency for drug deals.

With a ponzi scheme there is proposed value where there is none. Crypto currencies have value because they are directly tied to market conditions. i.e. a person using there cpu (which has value) and using their electricity (which has value) etc…. Southpark has a good explanation on why any economy’s currency needs faith for it work. https://www.imdb.com/title/tt1397941/

The value does not come from the mining. The value comes from the utility as a trusted ledger. The mining and the energy spent on mining are merely tools to implement this ledger. If you could figure out a way to maintain such an immutable distributed ledger without expensive mining, it would be worth even more.

Imagine spending a few years getting jerked around by a monetary policy thats determined by and for political reasons, where the value of your money is necessarily debased to support an economy where the vast…vast majority of currency in circulation is actually debt, then call bitcoin a ponzi scheme. Its ok, as long as we keep robbing you then everything will a-ok, heaven forbid capitalism actually delivers on its promise of making things cheaper over time, that would be bad for the banks.

All money is a ponzi scheme, as is government itself. It won’t go away just because it’s a ponzi scheme, as long as it has some qualities that people find useful.

You might wait a lot of time to see the fall of Bitcoin. In the mean time, i understand your frustration of not having to join it when it was the time, and having made you a multimilliair. I regret also. But i don’t see any use of wishing it to fall over. I missed it, you did too. We just have to accept it like a grown person and move on to our next missed opportunity

now? the previous 2 winters before proof of stake i heated my entire top floor with 3 gpus. if it wasnt for the gpu shortage id have heated my whole house. and i live in alaska.

Modern day heater runs the latest AI.

Yeah really, my natural gas bills were somewhat low for the winters of 2013-14 and 14-15… Summer of 14 it wasn’t worth it, but it was like 2c/kWh to the good by winter, and displacing ~ 20% natural gas use with hydroelectric power.

I’ve done that, but only because I have electric resistive heat already, and I only used the hardware I already had. If I had a furnace or a heat pump, or I had to buy new hardware, it wouldn’t make sense – I’d do better to save for a heat pump instead. There’s some now that can work pretty well even in extreme cold.

I think that the fair comparison is against a simple electric heater. The basic electric heater would cost … nothing compared to this to buy, but would cost $35/24h to run. So 5-6 24h days of use would cover $100 of purchase costs.

It’s still a bag of shite, and I wish we were throwing these incredible resources at BOINC or similar instead.

Not that I’d run a basic electric heater for 24h over its lifetime. We’re mostly looking at short-term cover for when the gas boiler is broken.

Depends where you live. Where I am electric costs from 3 cents to 10 cents a kW-h. A US space heater is 1500W max so $0.72 to $2.40 per 24 hours.

I have an HP server on the wall in my garage and it prevents anything from freezing in the winter. In the summer it can get kinda loud keeping itself cool.

Where do you live that a 1300 watt heater costs $35/day to run? That’s $1.12/kWh, 7 times the average US price.

Europe?

A quick google says average EU electricity prices are ~0.1 euro/kWh, highest still <0.2 euro/kWh.

My last invoice said 53ct/kWh ;-)

53ct / kWh in Germany, February 2023

In MA, we are ~$.25/KwH for generation and ~$.13/KwH for distribution so total ~$.38/KwH.. so nowhere near 1/7th..

That must be the highest in the US. (The Googler says Hawaii is the highest at 31 cents). Imagine what it will be when transportation and heat are all-electric! At least in MA you won’t have to built out a Rocky Mountains or Great Plains infrastructure.

Just remember that electric heating generally sucks to begin with. Joule per joule, gas and other chemical fuels are cheaper for generating heat. Obviously cost varies by locality, but I’ve found that only heat pumps have a fighting chance against gas. Maybe there is a locality were this could work, but there’s a decent chance that it will be cheaper up-front and in the long run to heat your home with gas.

Of course this doesn’t factor in the edge case of whether your nation’s economy will go full Weimar in a few years and you burn all your life savings in paper form for heat because it won’t even buy a piece of firewood anymore. In that case the paltry sum the miner stashes away might start looking worthwhile.

Bitcoin isn’t a sound investment for a sane market, there are much better things to put your money in for that. Bitcoin is a bet against the long-term stability of the legacy system. It’s an apocalypse investment, so to speak.

For instance, if you feel like staying awake a few nights, look at the relative size of the last three bank failures compared to the one big bank failure that set off the cascade in 2008. Look at the inverted yield curve at the end of 2019 and how much the world has been pumping into delaying the consequences of it the past several years. Maybe think about putting a tiny bit of wealth into something that’s not tied to the US system… Just in case. It might buy your family out of becoming prostitutes on the vicious streets of 1920s Berlin someday.

It has happened before, it has happened quite often in history… and the last time wasn’t even that long ago. People shouldn’t think this kind of preparation is for cranks.

This is different.

This time it’s every major currency on the globe, at the same time. The question is which goes first and how contagious? I’m thinking brit pound and very, but truth, I’ve been expecting it for a while now.

I expected ‘bad thing’ to happen the first time a US treasure bond auction failed to sell all the bonds. That happened 20 years ago.

Now the Federal reserve buys all the leftover t-bills, which are all short term now (not sure if that makes them bonds/bills). Full tilt circular.

Also when the Germans figured out there was nothing they could do about the Greeks/Italians/Spaniards printing Euros like Greeks/Italians/Spaniards. They took the ‘face save’, very un-German.

Anyhow, I don’t see how something that requires a functioning electric grid and internet is a great hedge against chaos. Will stick to diversified holding of acres coin, 7.62×39 coin, 30-06 coin, 9mm coin and 22LR coin for the 10% shit sandwich tranche of my holdings. Almost all in acres (at todays prices).

Long term crypto coins hold great promise in taking away currency printing power from government. When the whole world realizes the Ecuador was right, government has repeatedly proven to be drunken teens with credit cards. Ecuador just switched to US$, in time the US will just switch too. Crypto is the only alternative. Limited by math. Double plus good.

What’s the alternative? UN coin? Leaves?

It’s Ponies, but that’s another post.

The best and worst part about this post is that with how preppers/coiners talk I really can’t tell how much of it is a joke.

Make friends with some preppers and I guess you’ll find out :}

You forgot to mention the ‘Potato Coin’.

The sane preparation for a world spanning situation like that is to have a way to provide for your needs without money, because if all the markets break, you can’t expect to be able to find a useful trading partner in order to actually get any of your physical needs for “market” price using whatever currency hasn’t failed. Even in minor natural disasters, you can’t expect to buy what you need for market rates if at all.

The sane preparation when you think your specific country might not be a great place to hold your money is to hide various fractions of your money in other countries in addition to whichever cryptocurrencies seem prudent if any, and to have a way to leave if such a situation should occur. The sane option is never to throw a massive speculation into solely Bitcoin and then do very little else.

“Just remember that electric heating generally sucks to begin with. ”

Clearly there are some losses in the system. ;-)

I’d not say “generally” — for example imagine being somewhere far off grid with lots of water power. Just use the electricity for heating and leave the trees growing and skip the gas pipeline and the oil transport. Not a very common scenario, but try to recognize it when it appears.

Space heating with waste heat is hardly a new concept. Your car is very likely the most obvious example…Exception, air cooled cars.

The basic question is does the operation run at close to a profit or is it simply required? If so you’d be crazy not to use the waste heat, best you can.

>Exception, air cooled cars.

Not an exception – VW buses used to have a manifold around the exhaust pipe to heat the cabin air – and also sometimes cause carbon monoxide poisoning.

And most small planes have cabin heat.

VW heat boxes were the first thing to rust out. Never worked.

“You make money by finding suckers.”

Edited for brevity, and it teaches a more important lesson.

It would be unethical and immoral to let them keep their money.

Because money _always_ has the most utility in my hands. Duh.

Less philosophically: Somebodies going to get it, best it be me.

It’s also unethical and immoral to pay your taxes or to get caught not paying them. I digress.

>IS NOW A REAL THING

Guys from Comino and Qarnot did this back in 2017-2018.

And Nerdalize in 2017, who changed their name to Leafcloud. They sell a heater that rents containerised services out for business and science number crunching needs.

Great, heaters. Just in time for summer. Facepalm. And I’m in Texas where we have our own “independent” power grid. Where way too many foreigners are moving, yet they are saying we do not have enough power to support everyone comfortably through this summer (2023). Double-facepalm!

Summer is only upcoming for half the planet.

More than half of the populated english speaking land area.

Awesome. A new heater, just in time for summer. Where I’m at, too many people are moving. We were already told that our independent power grid will not be able to cool us comfortably this summer. So we might as well use up all the available energy and mine bitcoin while we’re at it. /s

All of the realistic understanding and comments aside about today’s BTC mining economics. There are some of us that did exactly this in 2010 with CPUs and GPUs. At first it was SETI and folding, then BTC and LTC. It’s probably still a good idea on some alt or meme coin, and certainly with SETI, folding, etc, but with your honking big gaming PC.

or just buy a used 3060 ti for about $200 and make $10 a month (at $.1 kw/h) while the price is up and have a extra GPU around to use as a spare when its not. Still get the spare heat and don’t have to share coinage with anyone.

The bitcoin scams never end.

I got a bunch of old miners that are obsolete in terms of making more money than they consume. I got them for the big fan/heatsinks, but I can not bring myself to rip them apart, so I have been trying to find someone who heats with electric to procure them from me. They will not make money, but they will get a “rebate” on their electric bill to the tune of about 75% back in coin. People laugh at me. I had one guy on another form tell me it would not work because the circuits in the miners and power supplies are inefficient. I guess resistors have them beat. So if you wanna be as cheap as possible use your heat pump until it gets too cold for that to work efficiently, and once you lose that, move on to the miners.

I heat my basement with 2 s19s when the off peak rate is $0.003. The gas furnace picks up the slack. In the summer I have enough solar to run one placed outside.

So many ignorant comments on digital technologies.

Bitcoin mining with proof of work is designed such that assuming people behave in a normal way, the value of the bitcoin produced and the value of the electricity consumed will tend to approach each other, although there must be a gap to pay other costs and to continue buying the latest fastest hardware, as well as to finally net a profit. A portable heater is one of the few cases where it’s unlikely someone has a better way to use the electricity, since furnaces or heat pumps aren’t likely for a portable indoor device. And that’s only assuming you value the money more than the chance to e.g. contribute to folding proteins to cure diseases.

Otherwise, reducing global energy consumption is critical, and anything that by its very nature has to consume as much power as it can afford is not the way to do that. Even as a variable load to engage solely in the instance where we have too much renewable power generation, which is not how it’s used, it’s not ideal. There’s a certain startup time, and it only produces money – it doesn’t for example produce a bunch of metal that you can avoid having to burn coal to produce later this week. It lets the producers get paid, which makes renewables a more attractive investment, but if the price is high enough it encourages fossil fuel plants to keep running too. Or are we not going to mention the whole strategy of finding places where it’s cheap and mining bitcoin using their fossil fuel power? Which is especially bad when you consider that nothing says you couldn’t have a situation where your mining makes the power simultaneously too expensive for the locals but still cheaper than in places where fossil fuels are at least somewhat more regulated and therefore expensive.

Ohh- this one’s for us pyros!!!!! Burn baby Burn!