By now, everyone and their dog has at least heard of Bitcoin. While no government will accept tax payments in Bitcoin just yet, it’s ridiculously close to being real money. We’ve even paid for pizza delivery in Bitcoin. But it’s not the only cryptocurrency in town.

Ethereum initially launched in 2015 is an open source, it has been making headway among the 900 or so Bitcoin clones and is the number two cryptocurrency in the world, with only Bitcoin beating it in value. This year alone, the Ether has risen in value by around 4000%, and at time of writing is worth $375 per coin. And while the Bitcoin world is dominated by professional, purpose-built mining rigs, there is still room in the Ethereum ecosystem for the little guy or gal.

Ethereum is for Hackers

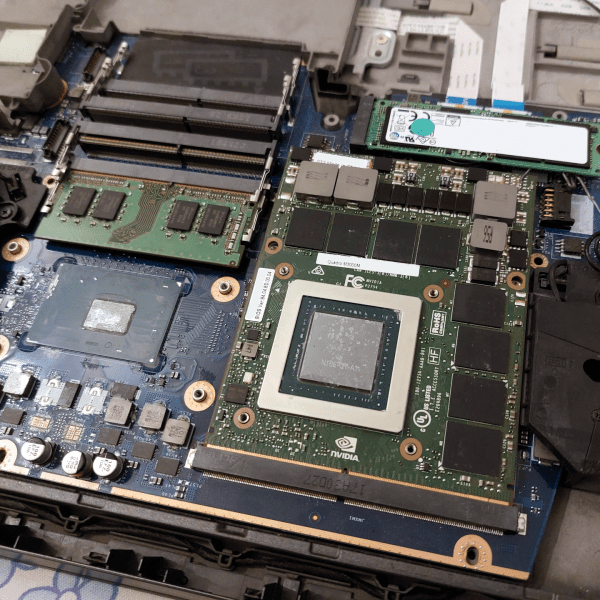

There may be many factors behind Ethereum’s popularity, however one reason is that the algorithm is designed to be resistant to ASIC mining. Unlike Bitcoin, anyone with a half decent graphics card or decent gaming rig can mine Ether, giving them the chance to make some digital currency. This is largely because mining Ethereum coins requires lots of high-speed memory, which ASICs lack. The algorithm also has built-in ASIC detection and will refuse to mine properly on them.

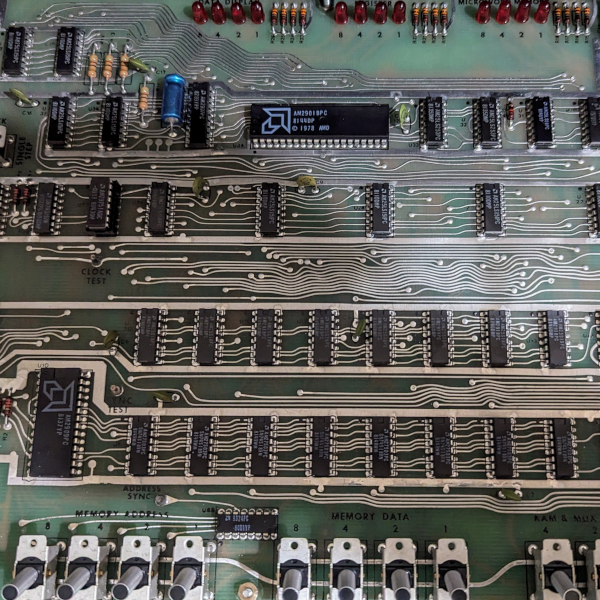

Small-scale Bitcoin miners were stung when the mining technology jumped from GPU to ASICs. ASIC-based miners simply outperformed the home gamer, and individuals suddenly discovered that their rigs were not worth much since there was a stampede of people trying to sell off their high-end GPU’s all at once. Some would go on to buy or build an ASIC but the vast majority just stopped mining. They were out of the game they couldn’t compete with ASICs and be profitable since mining in its self uses huge amounts of electricity.

Economies of scale like those in Bitcoin mining tend to favor a small number of very large players, which is in tension with the distributed nature of cryptocurrencies which relies on consensus to validate transactions. It’s much easier to imagine that a small number of large players would collude to manipulate the currency, for instance. Ethereum on the other hand hopes to keep their miners GPU-based to avoid huge mining farms and give the average Joe a chance at scoring big and discovering a coin on their own computer.

Ethereum Matters

Ethereum’s rise to popularity has basically undone Bitcoin’s move to ASICs, at least in the gamer and graphics card markets. Suddenly, used high-end graphics cards are worth something again. And there are effects in new equipment market. For instance, AMD cards seem to outperform other cards at the moment and they are taking advantage of this with their release of Mining specific GPU drivers for their new Vega architecture. Indeed, even though AMD bundled its hottest RX Vega 64 GPU with two games, a motherboard, and a CPU in an attempt to make the package more appealing to gamers than miners, AMD’s Radeon RX Vega 56 sold out in five minutes with Ethereum miners being blamed.

Besides creating ripples in the market for high-end gaming computers, cryptocurrencies are probably going to be relevant in the broader economy, and Ethereum is number two for now. In a world where even banks are starting to take out patents on blockchain technology in an attempt to get in on the action, cryptocurrencies aren’t as much of a fringe pursuit as they were a few years ago. Ethereum’s ASIC resistance is perhaps its killer feature, preventing centralization of control and keeping the little hacker in the mining game. Only time will tell if it’s going to be a Bitcoin contender, but it’s certainly worth keeping your eye on.

“The algorithm also has built-in ASIC detection and will refuse to mine properly on them.”

How exactly is that supposed to work?

I understand that one could design an algorithm which is not well suited for execution on some kind of hardware, but the article sounds like there is some kind of if(asic) sleep(100) in the algorithm which is plain stupid.

that’s not how it works. It’s just very RAM-heavy, which makes ASICs prohibitive compared to GPUs.

Regarding memory speed, sure. TFA said that. But TFA also states “The algorithm also has built-in ASIC detection and will refuse to mine properly on them.” which to me also says there is just a logic condition that should be trivial to remove/thwart

My point was that TFA is *wrong*. Shocking I know…

Its not that there cant be ASICs for ethereum, it is just very cost prohibitive to build them. There is no detection that happens, the algorithm that ETH uses is a “Memory Hard” proof of work algorithm. Memory hard means that the proof of work that is calculated along with each hash requires a lot of memory. An ASIC, in order to be efficient would need a TON of memory and would cost a lot more than the video cards that are used now.

According to the Ethereum white paper:

The current intent at Ethereum is to use a mining algorithm where miners are required to fetch random data from the state, compute some randomly selected transactions from the last N blocks in the blockchain, and return the hash of the result. This has two important benefits. First, Ethereum contracts can include any kind of computation, so an Ethereum ASIC would essentially be an ASIC for general computation – ie. a better CPU. Second, mining requires access to the entire blockchain, forcing miners to store the entire blockchain and at least be capable of verifying every transaction. […] one notably interesting feature of this algorithm is that it allows anyone to “poison the well”, by introducing a large number of contracts into the blockchain specifically designed to stymie certain ASICs.

Just as ETH is moving out of the realm of viability for hacker (read: less-than-100-GPUs) mining, HaD jumps on the bandwagon. Yey? Also, Proof-of-Stake (non-gpu-based) mining is supposedly coming….whether or not it actually happens is another matter.

I mine various currencies and pay my rent, buy food, video games, pay for Netflix, and trade stocks. :p

Are you also paying for your own electricity? You didn’t mention, and that’s an important detail.

Very efficient electricity–>fiat money converter. I hear some are even trying to tax it.

For those who have had “free” electricity at some earlier time in life (most likely college), who hasn’t wished for a way to turn that electricity into money?

Fascinating! Please expand, if you don’t mind. What part of the world do you live in, how large is your mine, how resilient are you to fluctuations in the currency market, and do you have a backup plan if things become unsustainable? And given the power requirements for an operation which I’m guessing is not small, do you think about the environmental impact at all?

I have to admit I like the idea of unbanking currencies especially in develoyregions. I’m not sure it works for me at this point in the US where my employer and entities I have credit with require a bank account. But the thought of someone far away (or close to home) using crypto currency to pay for things with their phone skipping any middle man is really compelling to me. But the impact of standing up KWh mines on anything but solar gives me pause. I don’t really consider any financial upside to be worth it to me personally.

Faiyazah – yes, the developing countries will be likely be the first to see mass adoption of the technology as they don’t have well developed banking and credit infrastructure that already works well for people. It will be funny how the western countries get leap-frogged in adoption due to having ‘good enough’ payment networks already.

I think there will be some truly amazing societal advances to come of blockchain technology. For instance, in the era of you-tube censoring content they don’t politically agree with (not that I blame them for disagreeing), and domain registrars similarly revoking service, it will feed blockchain based autonomous services such as steemit or dtube where there are no such gatekeepers. I think this is a needed service as most all developed nations appreciate and rely on free speech, and arguably social media and the web are today’s most prevalent forms of speech.

As far as the cost and environmental impact of mining – do gold investors or miners make the same consideration of their industry? There’s arguably a fair amount of environmental detriment coming from precious metals industries, so perhaps a better question is how does the environmental impact of this currency compare to alternatives. I’m hopeful that cryptocurrencies will, over time, switch more to proof-of-stake based systems, which are much less computationally intensive and should limit the amount power used. Ethereum is making this switch, but I must say, proof-of-work (mining) has been a very democratizing way to get ether into the hands of as many people as possible.

> such as steemit or dtube where there are no such gatekeepers.

If there are no gatekeepers at steemit and dtube (I know nothing about them), then what do they do if someone posts child porn there? Or are they free speech absolutists?

Do you also have a real job, or do you effectively contribute nothing to society, and just consume?

His day job is pulling bits of shiny metal from the ground while spilling heavy metal laden tailings across the Nevada desert.

Sorry for rehashing my earlier argument – it’s just useful in pointing out the falicy of the implicit argument: job = social benefit. If you have rationale for real job = social benefit, I would love to hear it.

My post was not centered on any environmental concern.

Gold actually has use. You can create wonderful things with it that can benefit society. You know, like that device you typed your post on. Gold miners are actually contributing something to society.

IMHO, Gold/market speculators are as useless as I was implying he may well be.

You probably know very little about mining. Read up, mining has a very specific purpose and it enables cryptocurrency network to work. If you’re saying enabling the $150B industry by spending your time/money/energy/comfort is not contributing to society – you’re lying to both yourself and others.

I’m saying if you applied the resources devoted to that $150B industry to something more worthwhile, humanity could advance as a whole at a much more expedient rate.

The same applies to most of the financial field.

Example: A software engineer could spend his time writing software for a computer to analyze a press release and buy or sell stocks based off that in <100ms.

Or, a software engineer could spend time writing software to maximize efficiency of a public transport system, enabling more people to get where they want to go faster, using less resources and less of their money.

Which of these actually produces a net benefit to society, and not just a transfer of wealth from one group of people to another?

Money was supposed to represent an owed debt. With the shenanigans that go on these days with fiat currency, fractional reserve lending, and now cryptocurrency, it's fast becoming a joke.

tbh that’s no different from most bankers! :p

I do all of those things without bitcoin. What is your point? :P

while cryptocurrencies are undoubtetly related to moneylaundering it has moved way past this point.

Blockchains are a valuable technologies that can enable many things that would otherwise pretty much unthinkable.

In regards of current uses for Ethereum: UNICEF is currently testing a System for internal Asset Management that is based on this blockchain.

So the usage, while still not extremely widely spread, is allready starting to benefit more people than just criminals.

The main problem of these blockchains is that their functioning *REQUIRES* that there are enough miners willing to invest both computing power and electricity to mine blocks. Who controls/owns the mining pools essentially owns the blockchain too – this has perfectly manifested itself recently when the Bitcoin forked thanks to some big profile miners not being happy with the status quo.

The crucial question is – do you really want to depend on a bunch of guys with a lot of money somewhere in Asia that are running the largest mining pools (and are likely linked to money laundering and crime too) for running critical infrastructure for you?

Because this is what most of the blockchain projects assume – that someone somewhere will always do the mining and thus enable adding transactions to the blockchain. However, few projects actually bother themselves with such details as who will guarantee that the miners will not jump to the new shiny thing/coin/protocol instead, leaving your project dead in the water a year later. They aren’t doing it because of their love for children (… UNICEF) but because they can currently get a lot of money that way. Once that dries up (and most of these “coins” are designed to become progressively harder over time) – or something else will be more profitable – bye bye …

thanks for your reply,

In regards to PoW i completely agree with your argument but please correct me if i’m wrong:

If Ethereum, as they currently plan, will introduce PoS to the blockchain, there will be no need for miners.

There still are risks of course but a loss of miners is none of them.

Well, PoS is only a different way of determining which blocks are valid. Mining hashes is another way. You will still need machines on the network doing it for you for the network to function. They won’t be called “miners” but “validators” and the burden is less than with mining, but you still need them – and they will need to be paid or otherwise motivated to keep participating in the system.

You do realize, however, that if miners leave a certain currency, the blockchain will adjust and it will be very easy to mine there (read more profit), which will attract the miners back.

The only scenario where loss of miners would kill the network is when the coin under discussion already costs 0 and no one needs it in the first place (good riddance).

Yes, of course. However, do you want to depend on something like that to build infrastructure for a system that has to be used for a decade or more? That doesn’t sound like a sound engineering to me (pardon the pun).

Once the goldrush period is over, good luck.

…– do you really want to depend on a bunch of guys with a lot of money somewhere in —– that are running the largest —– pools (and are likely linked to money —– too) for running critical infrastructure for you …. do you refer to Amazon cloud or Microsoft Azure ? …. same thing with other clothes …

Hackaday needs its own cryptocurrency. How about we call it the Benchoff Buck?

We already IP banned Annie, along with boxes/Linear B guy. Annie got around it in a day or two.

Now, I’m all for shitposting. I do it rather well. Annie’s shitposting is third-rate, thoughtless, unfunny, and unnecessary. If I see more of this crap, it’s another IP ban.

Why hasn’t anyone invented a coin that A: that has inbuilt inflation, something like 5% per year disappearing from your wallet and unhashed to be mined again and B: a fixed length encryption so mining didn’t become incrementally harder? That would solve the problem that haunts Bitcoin as everyone would rather keep them as they increase in value the longer you keep them thus making them unfeasible as a payment system. Bitcoin and other static coin systems have the property of Dutch tulip stock from the 1700’th century. At one point 95% of bitcoins in existence will be owned by a handful of people and the value will collapse. There is simply no incentive to spend them. It is like countries that have no capital tax. all money end up in the hands of a few wealthy families and society is left poor and uninvested.

From what I rember the increasing difficulty bit is to make a sort of technological cap on the amount of currency produced with the current gen of hardware, so that some schmo can’t but a bunch of quadro 9000s and mine a billion of whatever coin’s popular at the time.

As far as the devaluation, would you invest in something that’s guaranteed to disappear at a fixed rate, regardless of ROI? That doesn’t make a lot of sense to me.

As an invest object BTC is as good as it gets, however as a payment it will never be useful as it is in perpetual deflation. Why buy a car today if you can buy 5 next year for the same amount?

Do you have a job? Do you accept fiat currency in exchange for your labor? If so, then you are already investing in something whose value disappears at a relatively fixed rate.

Bitcoin tends to be based around political groups that think inflation in fiat currencies is the worst thing ever. They’re 21st century gold bugs. They see deflation as a feature, rather than a bug. They are wrong, for exactly the hoarding reasons you cite.

Still, if nobody spends it, then there’s no demand for it, so it’s value goes down.

This is my no-training-in-economics opinion. Somebody correct me if I’m wrong.

Funny, no mention of the time when hackers stole $70M worth of ethereum and the community decided to have a hard fork to give a refund for the victims.

Here’s an article with more information: https://www.cryptocompare.com/coins/guides/the-dao-the-hack-the-soft-fork-and-the-hard-fork/

The Ethereum community is wonderful. Nobody cares about the ideological bullshit which is crippling Bitcoin.

I bought Ether as soon as it came out and was glad to turn my $5 in Ether in 2015 to $230 in April.

If I owned it today it’d be worth $7,000 -_-

I really missed that boat. Oh well. $230 is nothing to sneeze at.

It could have gone the other way too, as hard as it may be I wouldn’t dwell on what I could have had you still made profit.

Indeed. It had gone up to $13 then back to $12 and I figured, might never go higher, get it while the getting’s good.

I actually paid nothing for it. Bought it with $5 in Bitcoin I got for signing up at Coinbase.

So that’s like… 230% profit… or something ;-)

To be honest I prob would have cashed out around $230 too,Coins are very volatile and that’s one of their main problems or benefits depending on how you look at it.

Yes, the volatility was another factor in my decision to sell. I did the right thing, I’m just doing some sour grapes pouting :-)

When Ether came out it was sub dollar.

Yeah I got 18 of them for $5 it was great.

your comment is as outdated as the article…

Dont need no cryptocurrency to buy drugs and guns. Just use usd in seattle

Its going to be a long time before governments fully recognize cryptocurrencies any time soon. Bitcoin, ethereum and all the others lack the “feature” for the governments to counterfeit trillions every year using banking tricks like the US feds do with the Dollar to help “pay” for severe deficit spending.

It’s not counterfeit if you control the supply, but they did make billions per day out of thin air to fix the 2008 crash, did they ever stop?

:-) Those who like to speak legalese and those who like to split hairs are justified in calling it something else than counterfeiting, but whatever word they choose to use will be a lame euphemism. For everyone else what the feds do to “create” money is just as destructive and dishonest as those printing C notes for themselves in a discrete facility. At the very least the federal government should be selling bonds at market prices to accommodate all debt increases. What goes on at the federal banking level is no less dishonest than printing money yourself. The only difference is that those in power bless one operation and try to stop the other while we all head along that path to slavery. Massive cryptocurrency use could put all that felonious/treasonous nonsense to an end and. Because of this, I expect the transition to be very dynamic as the powerful resist every new innovation that liberty minded people come up with. New solutions WILL keep coming and will ultimately prevail as sure as water seeping through an earthen dam. Its just a matter of continuous pressure and time. :-)

To answer your question, I don’t think they have stopped and had already been doing it prior to 2008. The shady “counterfeiting” that I’m talking about is what is left over as debt increase after removing all bonds and other legitimate publically visible loans. Few know to whom the debt is owed to and what their goals are. Its about as mysterious as dark matter. :-)

Also, space aliens are taking our jobs, and the newspapers are funding it.

Did you guys see that mining motherboard: http://www.anandtech.com/show/11739/asus-announces-b250-expert-mining-motherboard-19-expansions-slots

Talk about extreme, 19 PCIe slots.

And why is it back, was it gone? Because ETH crashed -20% again?

It’s a hell of a time for everybody to invest.

It’s still profitable to mine with gpu just see what is profitable https://whattomine.com/

One of the best to mine right now is XMR because the GPU miners for it is pretty new and there is a new generation of GPU miners for it, that are pretty good

If you use them you could a pretty good hash rate and earn abit.

One of the best miners atm for XMR is:

For Nvidia: https://mega.nz/#!MPwiULzR!ujXSfYrhBgP1re62WvElC6r7Zeivl-Gn4Is15vB-u1E

For AMD: https://mega.nz/#!BOogCS4Y!4fTZGyD35ZkRYsQ1k8nCIj0I65JZbeaKcJ0cH-IYe-0

And just a personal choice use mineXMR.com – Monero mining pool (http://minexmr.com) as pool.

Cryptocurrency is fiat, and I suspect those who mine it use other fiat to purchase cryptocurrency, and redeem their cryptocurrency i exchange for fiat so they have something they can purchase goods from those who don’t accept cryptocurrency. Mining for tangible resources is speculative, cryptocurrency mining is as speculative, and cryptocurrency is is an intangible. On taxes governments have taxed intangible assets in the past, so cryptocurrency has no inherent communities. Hopefully cryptocurrency mining will crash and burn before before it gets too pervasive, saving the non-speculators a lot of grief.

It is still profitable.. just for how long.. sooner or later we need another way than mining

I built by using ASUS B250 Mining Expert with 19 GPU, with P106-100, 7990, RX470, RX480. Has about 400Mh/s? Looking at ROI in 200-250 days. Bought most of item from http://www.bitbitminer.com