Cryptocurrencies: love them, hate them, or be baffled by them, but don’t think you can escape them. That’s the way it seems these days at least, with news media filled with breathless stories about Bitcoin and the other cryptocurrencies, and everyone from Amazon to content creators on YouTube now accepting the digital currency for payments. And now, almost everyone on the planet is literally bathed in Bitcoin, or at least the distributed ledger that makes it work, thanks to a new network that streams the Bitcoin blockchain over a constellation of geosynchronous satellites.

Blockchain Everywhere

Ardent supporters of Bitcoin often tout the robustness of the underlying network as one of the many advantages of cryptocurrencies: being built on the Internet, itself a decentralized network originally designed to provide connectivity in times of crisis, they provide a means of exchange independent from central authorities and resistant to any sort of capital controls that might be enacted by them.

But the comeback to those arguments is obvious: since Bitcoin relies on the Internet, a government intent on clamping down on the use of cryptocurrencies could simply turn off the Internet, at least theoretically. And even absent an authoritarian dystopia situation, Internet access is still far from universal. There are many places in the world where access is limited, at best, and often expensive, especially for the proof-of-work (PoW) transactions needed to mine Bitcoin. This necessarily limits the Bitcoin network mainly to the developed world.

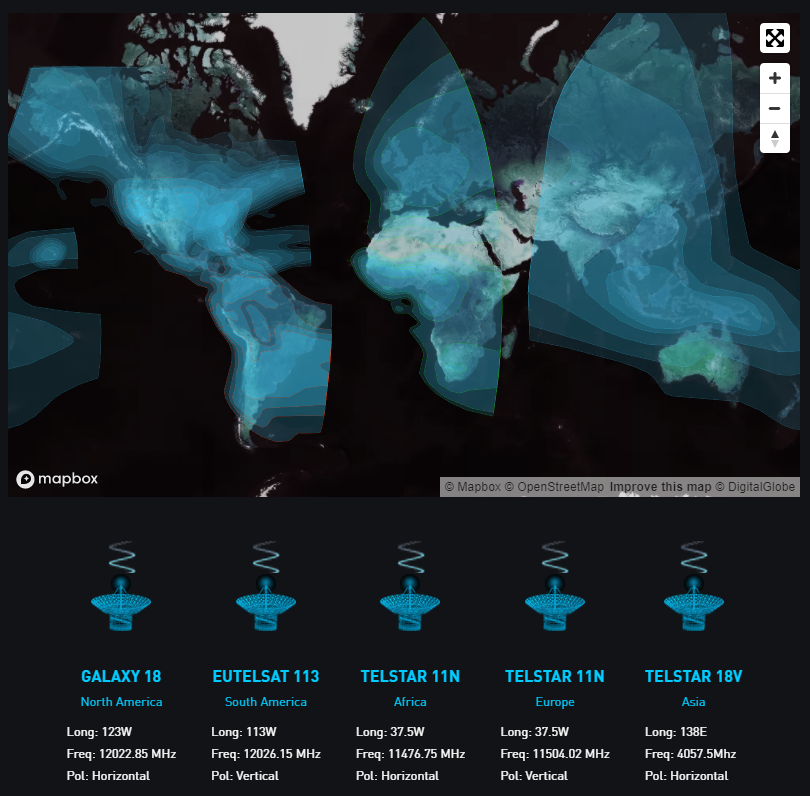

Blockstream, a company set up in 2014 by crypto-hacker Adam Back, aims to change that. They announced in 2017 the launch of Blockstream Satellite, a one-way broadcast of blockchain data over four commercial geosynchronous satellites. At the time of the system’s launch, about two-thirds of the landmass of the globe was covered by blockchain broadcasts from on high. As of early 2019, a fifth satellite brought the Asia-Pacific region online, giving access to almost the entire globe. Also added in the 2019 release was an API that allows users to send files to the entire network.

It’s important to note that Blockstream Satellite is a one-way system, at least for now. It only allows users to receive blockchain broadcasts; if a user wants to participate in a Bitcoin transaction, there still needs to be some sort of connection to the Internet. This would seem to bring us back to the original problem in terms of universality of Bitcoin, and in some ways it does, but Blockstream points out that there are low-impact ways to access the Bitcoin network. For example, a Bitcoin wallet on a smartphone could be connected to a satellite node, which could then, in turn, participate in a local mesh network to bring Bitcoin to a small village or isolated community.

Roll Your Own

The hardware needed to set up a Blockstream Satellite node is surprisingly simple, and will be familiar to any SDR hacker. A detailed GitHub page documents the entire setup, which centers around a small satellite dish and low-noise block downconverter (LNB) of the type used for direct-access satellite TV. Because the satellites are geosynchronous, no complex tracking mechanisms are required; once the dish is aimed using the usual tools, the fun can begin. The LNB is connected to a cheap SDR dongle, and the software stack includes apps like GNURadio and GrOsmoSDR. Once a node is running and properly aligned, blockchain transfers are taken care of by BitcoinFIBER. Several hackers have documented their Blockstream satellite setups, too.

Again, this setup is just for receiving blockchain broadcasts, and an Internet connection of some sort is required to exchange Bitcoin. But it still provides a path to Bitcoin use in areas that currently have no other way into the Internet. It also enables Bitcoin mining operations for those with expensive Internet connections, since the blockchain stream is received free over the air.

Perhaps this all means we’ll someday see solar-powered Bitcoin mining operations quietly hashing away at some remote location with nothing but a small satellite dish connecting them to the network. But to Blockstream and to cryptocurrency devotees, that’s not the point. To them, this is about strengthening the core feature of crypto: freedom from any central authority’s control of currency.

Wow, they’ve engineered a way to make “money” fall from the sky. Why not icecream next?

Almost that. Money aren’t falling from the sky, but money transfer logs.

Put a solar panel together with a mining rig, and maybe that counts as money from the sky.

Having actually done it (albeit for altcoins, not Bitcoin), I have to say that solar powered mining is a great idea, if you get in early enough which is true of mining in general.

I wonder if some low bandwidth, long range wireless networks like LoRa might be a solution for sending transactions onto the network. Most Bitcoin transactions are less than a kilobyte.

Plot twist: They will use blockchain as command and conquer platform for army of killing (dog) robots…

The latency is way too big for that. 20 minute per block on average is too much for commanding any army of bots.

Better use HAM radio repeaters for that.

Is bitcoin reaaaally that ubiquitous though? The breathless reporting on it these days seems mostly about its fundamental flaws, massive market manipulation, susceptibility to very old grifts and cons, and security vulns that make it not quite as trustworthy or foolproof as advertised as a ledger. Oh, and the real killer: virtually nobody uses it to buy goods and services. It’s not anywhere near as efficient than centralized, it’s not even as secure as centralized (despite over-hyped claims), and there’s no real organic mainstream adoption.

A currency can’t survive on speculation alone, and most of those products and services that accept payment in crypto haven’t had a single taker in all the years that option has been offered. Even for products marketed towards the tech-savvy early adopter types. Outside a small but thriving black market, there’s virtually no economy being powered by crypto. Just a bunch of people buying it and sitting on it with hopes that somebody else will pay more later.

I don’t think gimmicks are gonna save it. For it to become relevant and for it to complete its (admittedly dubious) libertarian mission, somebody needs to start buying groceries with it or something.

I have read those arguments time and time again, and they are overblown. For and against.

Fundamental flaws are the same as any central bank money: it’s value depends more or less on trust. There’s why money printed by Saddam Hussein and the Somali Central bank are still in circulation. Ask Google for Somali shilling or Swiss Dinars. If people trust it and use it, anything has value.

Market manipulation is a problem, but only if you view bitcoin as a store of value. If you see it as a value transfer, this problem goes away. I bought my current OnePlus using it. The seller would not accept my card, but would accept BTC. I bought some, transferred to him, and he sent me the phone. I don’t live in the US, so I prefer paying in BTC when available, because the exchange ratio is way better than paying on my credit card. I can pay VPN, my co-location hosting provider, even buy things on Amazon using a remailer, paying on BTC. I pay around 15% less using BTC.

Security vulnerabilities making it not trustworthy is something I am not aware of. There are vulnerabilities on some wallets, but that does not affect the blockchain in any way. As far as I know (and I am on the field for a while), no vulnerability on the ledger has been found. There’s the issue of a 51% attack, but the cost to execute it is on the millions of dollars, so it’s not really feasible.

Acceptance is small, but increasing. Overstock.com, NewEgg, NameCheap, Shopify, Proton Mail, Private Internet Access, NordVPN, SurfShark, CyberGhost, and a lot more. Steam used to accept it, but the fees where so high they dropped that option. With fees going down again, and with advances of the protocol, maybe they will use BTC again, maybe not.

On the other side, adoption after 10 years are still slow. It’s not easy to get into the market for the first time, and its mechanics are complex for the non-initiated.

Buying and spending is not something mainstream users are able to do, as they need to overcome a lot of hurdles: KYC forms, choosing an exchange, wrestle with their banks for buying BTC, downloading and securing the wallet, or lefting the coins at the exchange and risk losing everything if the exchange is hacked or goes dark.

Exchange security is woeful. Time and time again they are hacked and funds stolen. If you take into account that virtually anyone can start his own exchange with no oversight whatsoever, I am surprised there are so few hacks. But as the market matures, better managed exchanges will draw more clients from the poorly ones, and things will get better.

Market manipulation is real, but smaller than it seems. The biggest manipulation in use today is inflated order book sizes. Exchanges (specially small ones) do this all the time, so it seems that their books are deep, and their have a lot of liquidity. Doing so attracts more people, bringing more transactions and more fees. Outright price manipulation is almost impossible today, as the market size is above 80 billion USD. Smaller than most public traded companies, but I doubt anyone with billions of dollars in cash somewhere would like to risk that amount trying to game the market.

Don’t expect to buy groceries with BTC. The payment confirmation is too high for that. You won’t want to stay on the cashier for 45 minutes waiting for the payment to clear. Better use Ripple or another coin for that.

And the black market does not run on BTC. It’s a common misconception. Any and every single BTC transaction is public, and I don’t believe drug dealers and users will want their entire financial life to be public and stored forever. Black markets uses the so-called “privacy coins” Monero, Dash, Zcash, PIVX…

And that gives the next issue: the myriad of coins. There must be a thousand or more. Ripple, Stellar, Monero, Smartcash, Smartcoin, Bytecoin, Bitcoin, Bitcoin Cash, Bitcoin Gold, Bitcoin Adamantium, Bitcoin Unobtanium, and the likes. Anyone can “git clone” a repo, fork it, and create his own coin, and that increases the confusion…

There are issues, sure, Bitcoin is not as important as their proponents tell, and not as doomed as the detractors. But it’s here, and it’s working (for a certain rate of “working”).

I don’t think BTC needs to be saved…

There a built-in incentive for fraud if you go to buy a sandwich and either you or the sandwich maker, or both are printing the money, as opposed to a trusted third party.

Unless you are a crypto developer and you are pushing your own crypto, you cannot print your own money. You can mine it, but I assure you any mined crypto is thouroghly earned. All the respectable cryptos are designed to make counterfieting and inflation inducing inventory flooding impossible. No one is printing money, not even governments when it comes to crypto. That is one of it’s biggest strengths.

I agree that debasing of a currency is a problem, but meaningful deflation occurs via higher interest rates. For example one can compare what a dozen eggs costs today as a percent of income versus what a dozen eggs cost 100 years ago as a percent of income. It is roughly the same percent.

yea, it just goes to show just how wibbly-wobbly infationary/deflationary money can get. People/organizations sometimes tie a currency to something percieved as valuable like silver and gold but even they change in value over time. Look at the price of aluminum over the last 250 years. The US paid for the Louisiana Purchase to Napoleon with bars of aluminum which at the time was more precious than gold. Based on the last 250 years of history chicken eggs would probably make for a better base for price but obviously not the kind of thing one can stockpile and build up as a reserve. :-) In trade the value of everything is wibbly-wobbly. It’s just that some things are more so than others. Perhaps it is the differences in percieved value that helps drive commerce, encouraging trade. When the trade happens, both sides think they are winning for both value and trend.

Distributed consensus addresses that, which is why it takes so long to confirm a transaction.

I like to keep an eye on Bitcoin related stuff just because of that. I wish there was a leaner implementation of it.

One could limit blockchain bloat and deal with lost coins if transactions older than x years of age (y number of blocks) would be declared null forcing a “move it or loose it” policy. If you move the value of an old wallet to a different wallet the transaction would be new and on a fresh block and the countdown clock would be reset for that amount of bitcoin. If the btc is not moved it is declared “lost” and would be unrecoverable except possibly through mining. Mining rewards could be declared to follow the usual halving schedule with a supplemental amount equal to a small percentage of the total lost coins. Older blocks including the genesis block would then be discardable because all transactions on them would be void. A huge benefit to all this is that one could fork in new and stronger encryption if needed down the road in case the quantum computing hounds get on btc’s tail.

Hey Satoshi!!! If you are still out there you might want to consider this idea and speak up about it!!!! (You also might want to move some of your btc before such an idea gets implemented.)

And odd timing the latest Humble is about Blockchain and Cryptocurrency.*

*Too many videos IMO.

“freedom from any central authority’s control of currency.”, sure the folks with receiver dishes can see blochchain updates free of the ability of local nations to stop them, but this is dependent on 5 satellites and the organiation which operates them, doesn’t sound so decentralised any more. Also I’m sure anyone tuning in would find something like an uncensored copy of wikipedia in all major languages, repeating daily perhaps, to be a more useful thing to watch than blockchain transactions which they are not (without local ground interent connection) able to transact in anyway.

I think is is more useful as a proof of concept. The same mechanism pulling data from satellites can be used to pull data from HAM radio, or mesh networks, or AM broadcast. It’s only the downstream now, but HAM radio could be used to provide the upstream if someone on the network of repeaters have an internet uplink.

I seriously doubt this method would be used… Too complex to the average and way-above-average user…

Yeeeeears ago, back when ISDN lines were an expensive luxury few home users could afford, I remember a similar service that was offered to ISPs, to deliver them a copy of the Usenet News feed by satellite. This freed up their backbone connection from needing to carry so much Usenet traffic, while still providing a feed to users. Any missed articles or uploads would go by the normal connection, but the vast majority would be handled by satellite instead.

Found an ad for it here: https://archive.org/details/Boardwatch_Magazine_Vol_09_03_1995_Mar/page/n35

They probably still do that since one to many. mostly one-way still works well for NNTP.

Bitcoin is for rebels, people who don’t like being told by “the man” what they may or may not do with their possessions. … hmmmm … sounds like Hackaday hackers IMHO. This satellite network is one more small step towards liberty for all. The trip along the Oregon trail seemed horribly long and treacherous but people got there one step at a time. Of course there will be dead along the way and many will “die” of crypto-disentary but many will not die and eventually enough will get there and someone will build a railroad and the new financial order will be established where no-one has their thumbs in everyone’s pies.

Who is the person to tell me my purchase of a sandwich in cash is not a trusted economic transaction by default, and that the only was for the transaction to be trusted is for there to be a date/time stamp of it with an amount and account numbers? I speak for myself only but I will have nothing to do with someone who assumes lack of trust by default.

It’s not that a lack of trust is assumed. It’s just that in some situations it is still prudent to do business with someone you actually don’t trust. It’s an upgrade to the range of interactions people can have, not a restriction or an insult. I’d gladly sell a hotdog to a total stranger about as easily as I would sell it to my best friend if I get paid first. Most of the talking about trusting in crypto is about 3rd parties. You may already trust the person you ar paying, but with regular money transactions, you also must trust your own bank and the recipient’s bank too along with other entities who may be involved in the network. In crypto, you don’t need to trust anyone else, just the person you are trying to do business with and even that is unnessessary if you would rather trust an agreed-upon middleman providing escrow.

I respecfully disagree that there isn’t a trust requirement. In my view, it’s the cryptographic function that engenders a much larger portion of the total trust requirement.

Furthermore, in the everyday world, trust is already there, built and reinforced passively. The fact that I can pass a stranger on the street and neither I nor the other person worry about muggings (presumably) reinforces the trust that already there between total strangers.

I think we are comparing apples to oranges here. In previous statements my meaning of trust applied only to entities involved. For you trust also seems to apply to things (like the mathematical system of cryptography and social norms) If I changed my working definition to what I think I see in your statement, I would agree fully. :-) (I still think the narrower definition is more useful) …words…hard to nail them down sometimes… :-)

It has come to the notice of authorities that many unregulated companies are using clone websites to target citizens and hence it has issued a warning to all traders not to deal with any unregulated companies and not to be lured by their false propaganda of unrealistic returns on investments, and not to fall in their trap. Their advertisements can be mouthwatering, but at the end of the day they will runoff with your capital too. Thanks to Hack Assets they helped me recovery most of my lost funds, you can contact bitcoinrecoveryteam{@}yandex,ru and share the testimony they shouldn’t keep ripping people off

I got the prof contact from a colleague at work when bitcoin was going up all the way up last week. I’ve been working with the prof for 5 days and i can confirm he help me mine 2.5 btc in total. I am still working with him to get more coins because i can never afford to lose this great opportunity at all. The crypto market is at a crucial point, If you have been wondering where to start and have some questions, I will advice you to email prof Sydney right away and he will personally put you through. (Profsydneycryptoconsultancy AT gmail DOT com)

I got my 9.756 BTC from this great man within 3 days….I got the prof info in a crypro forum where everyone drop their testimonies about how prof change their financial status and that led me to email the prof because i really need to get my bitcoins because i read that it is safe to acquire bitcoins when the price is low but i don’t have enough money and you know what it cost to buy 1 bitcoin now. I contacted the prof and he explained and lead me to open a blockchain account where i could save and keep my cryptos after minted. He never asked for my password nor my login info to my account. He showed me his basic subscription mining package and i go for 9.756 BTC and prof sydney help me mine it all within 3 days. I am so exited and couldn’t keep calm because i can reinvest again, Prof sydney is the best mining expert and analyst. You can get to him for more info Profsydneycryptoconsultancy at gmail dot com He is the best

He is the best

Here is my own story on how prof Sydney changed my financial status when i think i lost everything but the prof came through…..Some hackers rob me of my $500 btc and i was so sad and looking for how to recover my lost btc and that’s how i met the prof and i told him about how my bitcoin was stolen and asked if he could help me recover my $500 btc but the prof advise me to forget about the stolen btc and asked me to join his mining team….After some elaborations about how the btc are minted i decided to join his mining team and i got to see how it is done when he help me mine 1.542 btc to my blockchain wallet in 3 days. I cannot believe it until i converted the btc to usdPax and i have my money in $$. The prof is the best and i’m so happy i join the mining team. Thank me later (Profsydneycryptoconsultancy at gmail dot com)

You can start earning money at the comfort of your home. I met the prof via a cryptocurrency forum and he is into bitcoin and other cryptocurrency mining. Banks and places are shutting down due to the Covid-19. I talked to the prof about making money from home and he explain more on what bitcoin mining is all about and i get to realize i can earn up to 8.5% of my invested capital in 3 days. I worked with the prof and he did come through. I earn about $15K in 2 weeks and i am still going to invest more with the prof to get more bitcoins. Contact the prof to join the mining team so you can begin your journey to come a millionaire. I provided his email below. (Profsydneycryptoconsultancy AT gmail DOT com)

Most crypto exchanges such as Kraken take advantage with customers funds because they feel these customers don’t know how to get their funds back, But trust me there are hidden ways you can get your lost funds back from the broker. I was able to withdraw my 7BTC from kraken, If you want to recover your money back then mail recoverywealthnow360 at gmail dot com

If the fees were lower we could transmit Web pages through this service. HTML and Javascript can be minified and compressed with an efficient algorithm such as Brotli or one of the PAQ variants. Every few days you transmit the complete site, and in between send incremental updates. Google’s Web Bundle standard could be useful for this. That way we can have a Web-1.0 like service but without the major privacy issues that plague the Internet.