It could be said that there are a number of factors behind the explosion of creativity in our community of hardware hackers over the last couple of decades, but one in particular that is beyond doubt is the ease with which it has been possible to import small orders from China. See something on AliExpress and it can be yours for a few quid, somewhere in a warehouse on the other side of the world it’s put into a grey shipping bag, and three weeks later it’s on your doorstep. This bounty has in no small part been aided by a favourable postage and taxation environment in which both low postage costs and a lack of customs duties on packages under a certain value conspire to render getting the product in front of you a fraction of the cost of buying the thing in the first place. Continue reading “EU Duty Changes, A Whole VAT Of Trouble For Hackers?”

trade5 Articles

Rare Earth Metals Caught In Trade War

It seems these days that the news is never good. Speaking from experience, that’s really nothing new; there’s always been something to worry about, and world leaders have always been adept at playing the games that inevitably lead to disturbing news. Wars always result in the very worst news, of course, and putting any kind of modifier in front of the word, like “Cold” or “proxy”, does little to ameliorate the impact.

And so the headlines have been filled these last months with stories of trade wars, with the primary belligerents being the United States and China. We’ve covered a bit about how tariffs, which serve as the primary weapons in any trade war, have impacted the supply of electronic components and other materials of importance to hackers.

But now, as the trade war continues, a more serious front is opening up, one that could have serious consequences not just to the parties involved but also to the world at large. The trade war has escalated to include rare earth metals, and if the threats and rumors currently circulating come to fruition, the technologies and industries that make up the very core of modern society will be in danger of grinding to a halt, at least temporarily.

GoPro Factory Goes Nomad To Dodge Tariff Threat

Despite the fact that the United States and China are currently in the middle of a 90-day “cease fire” in their ongoing trade war, with new tariffs on hold until March 2019 while the two countries try to reach agreement, not everyone is waiting around to see who comes out on top. In a recent press release, action camera manufacturer GoPro has announced their intention to move some production out of China in the face of potential tariff expansions; which many analysts fear will be the result of the current stalemate. That’s right, only some of their production is moving.

“We’re proactively addressing tariff concerns by moving most of our US-bound camera production out of China,” says GoPro CFO Brian McGee. “We believe this diversified approach to production can benefit our business regardless of tariff implications.” Reading his words carefully, the key phrase here is “diversified approach”. GoPro doesn’t intend to move their entire production capability out of China, but only the production of the cameras which are designated for importation into the United States. GoPro models which are to be sold to other parts of the world will still be made in China.

This might seem an extravagant move just to avoid US tariffs, but with better than 40% of GoPro’s revenue for the third quarter of 2018 coming from the Americas, the company stands to be hit hard by the proposed 25% tax. Combined with the fact they shuttered their drone division last year citing “an extremely competitive aerial market”, and the proliferation of “GoPro clones” available for pennies on the dollar, it seems pretty clear that belt-tightening is the name of the game for the company that was once synonymous with action cameras.

Continue reading “GoPro Factory Goes Nomad To Dodge Tariff Threat”

Bunnie Weighs In On Tariffs

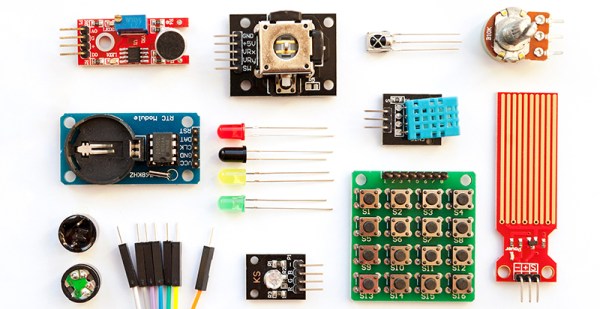

[Bunnie] has penned his thoughts on the new 25% tariffs coming to many goods shipped from China to the US. Living and working both in the US and China, [Bunnie] has a unique view of manufacturing and trade between the two countries. The creator of Novena and Chumby, he’s also written the definitive guide on Shenzen electronics.

The new US tariffs come into effect on July 6th. We covered the issue last week, but Bunnie has gone in-depth and really illustrates how these taxes will have a terrible impact on the maker community. Components like LEDs, resistors, capacitors, and PCBs will be taxed at the new higher rate. On the flip side, Tariffs on many finished consumer goods such as cell phone will remain unchanged.

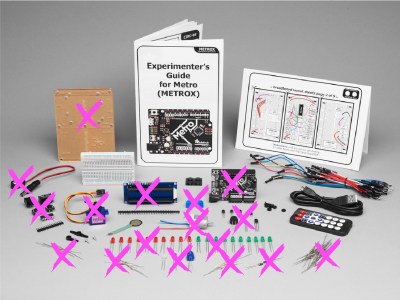

As [Bunnie] illustrates, this hurts small companies buying components. Startups buying subassemblies from China will be hit as well. Educators buying parts kits for their classes also face the tax hike. Who won’t be impacted? Companies building finished goods. If the last screw of your device is installed in China, there is no tax. If it is installed in the USA, then you’ll pay 25% more on your Bill of Materials (BOM). This incentivizes moving assembly offshore.

What will be the end result of all these changes? [Bunnie] takes a note from Brazil’s history with a look at a PC ISA network card. With DIP chips and all through-hole discrete components, it looks like a typical 80’s design. As it turns out the card was made in 1992. Brazil had similar protectionist tariffs on high-tech goods back in the 1980’s. As a result, they lagged behind the rest of the world in technology. [Bunnie] hopes these new tariffs don’t cause the same thing to happen to America.

What will be the end result of all these changes? [Bunnie] takes a note from Brazil’s history with a look at a PC ISA network card. With DIP chips and all through-hole discrete components, it looks like a typical 80’s design. As it turns out the card was made in 1992. Brazil had similar protectionist tariffs on high-tech goods back in the 1980’s. As a result, they lagged behind the rest of the world in technology. [Bunnie] hopes these new tariffs don’t cause the same thing to happen to America.

[Thanks to [Robert] and [Christian] for sending this in]

Making Electronics Just Got 25% More Expensive In The US

As reported by the BBC, the United States is set to impose a 25% tariff on over 800 categories of Chinese goods. The tariffs are due to come into effect in three weeks, on July 6th. Thousands of different products are covered under this new tariff, and by every account, electronic designers will be hit hard. Your BOM cost just increased by 25%.

The reason for this tariff is laid out in a report (PDF) from the Office of the United States Trade Representative. In short, this tariff is retaliation for the Chinese government subsidizing businesses to steal market share and as punishment for stealing IP. As for what products will now receive the 25% tariff, a partial list is available here (PDF). The most interesting product, by far, is nuclear reactors. This is a very specific list; one line item is, ‘multiphase AC motors, with an output exceeding 746 Watts but not exceeding 750 Watts’.

Of importance to Hackaday readers is the list of electronic components covered by the new tariff. Tantalum capacitors are covered, as are ceramic caps. Metal oxide resistors are covered. LEDs, integrated circuits including processors, controllers, and memories, and printed circuit assemblies are covered under this tariff. In short, nearly every bit that goes into anything electronic is covered.

This will hurt all electronics manufacturers in the United States. For a quick example, I’m working on a project using half a million LEDs. I bought these LEDs (120 reels) two months ago for a few thousand dollars. This was a fantastic buy; half a million of the cheapest LEDs I could find on Mouser would cost seventeen thousand dollars. Sourcing from China saved thousands, and if I were to do this again, I may be hit with a 25% tariff. Of course; the price on the parts from Mouser will also go up — Kingbright LEDs are also made in China. Right now, I have $3000 worth of ESP-12e modules sitting on my desk. If I bought these three weeks from now, these reels of WiFi modules would cost $3750.

There are stories of a few low-volume manufacturers based in the United States getting around customs and import duties. One of these stories involves the inexplicable use of the boxes Beats headphones come in. But (proper) electronics manufacturing isn’t usually done by simply throwing money at random people in China or committing customs fraud. These tariffs will hit US-based electronics manufacturers hard, and the margins on electronics may not be high enough to absorb a 25% increase in the cost of materials.

Electronics made in America just got 25% more expensive to produce.