Despite the fact that the United States and China are currently in the middle of a 90-day “cease fire” in their ongoing trade war, with new tariffs on hold until March 2019 while the two countries try to reach agreement, not everyone is waiting around to see who comes out on top. In a recent press release, action camera manufacturer GoPro has announced their intention to move some production out of China in the face of potential tariff expansions; which many analysts fear will be the result of the current stalemate. That’s right, only some of their production is moving.

“We’re proactively addressing tariff concerns by moving most of our US-bound camera production out of China,” says GoPro CFO Brian McGee. “We believe this diversified approach to production can benefit our business regardless of tariff implications.” Reading his words carefully, the key phrase here is “diversified approach”. GoPro doesn’t intend to move their entire production capability out of China, but only the production of the cameras which are designated for importation into the United States. GoPro models which are to be sold to other parts of the world will still be made in China.

This might seem an extravagant move just to avoid US tariffs, but with better than 40% of GoPro’s revenue for the third quarter of 2018 coming from the Americas, the company stands to be hit hard by the proposed 25% tax. Combined with the fact they shuttered their drone division last year citing “an extremely competitive aerial market”, and the proliferation of “GoPro clones” available for pennies on the dollar, it seems pretty clear that belt-tightening is the name of the game for the company that was once synonymous with action cameras.

Continue reading “GoPro Factory Goes Nomad To Dodge Tariff Threat”

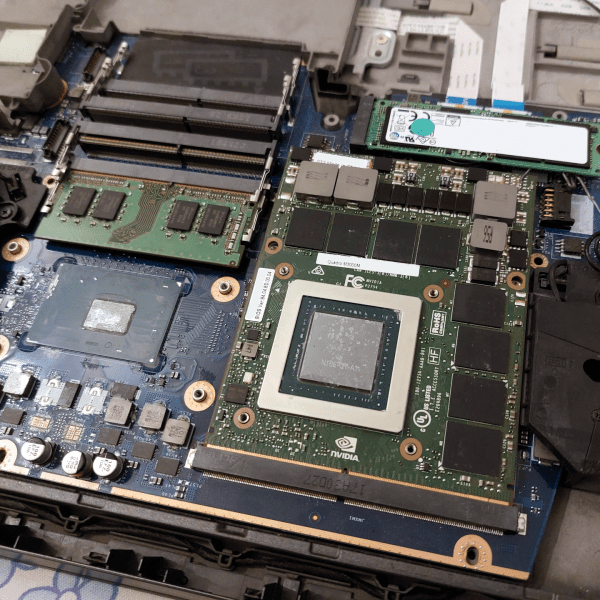

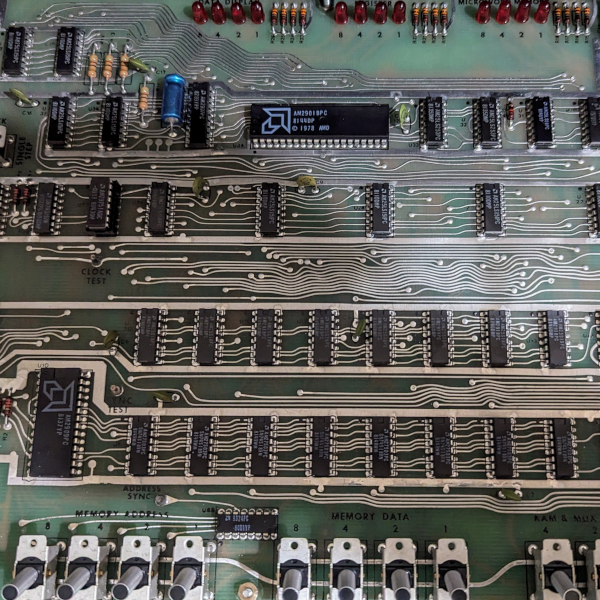

What will be the end result of all these changes? [Bunnie] takes a note from Brazil’s history with a look at a PC ISA network card. With DIP chips and all through-hole discrete components, it looks like a typical 80’s design. As it turns out the card was made in 1992. Brazil had similar protectionist tariffs on high-tech goods back in the 1980’s. As a result, they lagged behind the rest of the world in technology. [Bunnie] hopes these new tariffs don’t cause the same thing to happen to America.

What will be the end result of all these changes? [Bunnie] takes a note from Brazil’s history with a look at a PC ISA network card. With DIP chips and all through-hole discrete components, it looks like a typical 80’s design. As it turns out the card was made in 1992. Brazil had similar protectionist tariffs on high-tech goods back in the 1980’s. As a result, they lagged behind the rest of the world in technology. [Bunnie] hopes these new tariffs don’t cause the same thing to happen to America.