Kickstarter is not an investment, and no matter how many times this is repeated, you’ll find the phrase ‘my investment’ in the comments section of nearly every failed Kickstarter, Indiegogo, or other crowdfunding campaign. These campaigns are more closely related to group buys, and you’ll never find a Kickstarter offering equity or any sort of return beyond the latest electronic bauble, indie game, or graphic novel. Sure, you may bootstrap a business with that pledge, but don’t expect dividends from Ouya or Pebble.

Now, this may finally change. The US Securities and Exchange Commission approved new rules for crowdfunding, allowing startups to raise money from Jane and Joe Internet.

Previously, angel investments, venture capital, and hedge funds were not for the common man; these were high-risk investments, and only accredited investors could participate in these funding rounds. Accredited investors, at least in the US, are individuals with a net worth of at least $1 Million, or an income greater than $200,000 in each of the previous two years. The reason for only allowing accredited investors – depending on your interpretation – is to protect consumers or to maintain a perverse oligarchy by installing a glass ceiling over the middle class. Either way, normal people couldn’t invest in high-risk investments until now.

Congress has seen fit to create a new class of investor, and pursuant to Title III of the JOBS Act, the SEC recently released the complete rules for crowdfunded investment. In a massive, 600-page tome, all the regulations are laid bare, ready for the next serial entrepreneur who seeks at most $1 Million in investment for their next startup.

Investors and Startups

The rules issued by the SEC immediately place some limitations on what can be done under the new regulations. For startups, a maximum of $1 Million can be raised over a 12-month period.

For investors with an annual income or a net worth of less than $100,000, a maximum of $2,000 or 5% of annual income can be invested, whichever is greater. For investors with an annual income or net worth greater than $100,000, 10% of their income or net worth can be invested, whichever is smaller.

Brokers and Funding Portals

Investors and entrepreneurs are not allowed to keep their transactions to themselves; this is the SEC after all. Transactions will go through registered broker-dealers or something called a ‘funding portal’. These funding portals are forbidden from offering advice, making recommendations, advertising, paying employees a commission, holding securities themselves, and the regulation bars directors, officers, and partners of the funding portal from holding investments using that funding portal’s services.

It’s The Complete Opposite of Kickstarter

Kickstarter was never known for its transparency. While the basic premise of crowdfunding the manufacturing of a few baubles or 3D printers is sound – it’s cheaper per unit to build a hundred of something than to build just one – the reality of actually building something meant Kickstarters failed – it’s exponentially harder to build ten thousand of something than it is to build a hundred. Add to this Kickstarter’s investments in campaigns featured on their website, and you have the recipe for practices that aren’t illegal but certainly don’t pass the sniff test.

The regulations put forth by the SEC turn the most common trope of the Internet economy on their head; companies responsible for bringing startups and investors together are not financially dependant on these startups. Companies can not raise more money than they could handle, and hopefully individual investors won’t take to crowdfunded companies like online poker and day trading.

Traditional crowdfunding has started a lot of great companies so far; the Form1 printer began as a crowdfunding campaign, and Reading Rainbow still lives thanks to a successful Kickstarter. With these new regulations come new possibilities for the latest startups, and more paths to success than a traditional angel investor or VC tycoon.

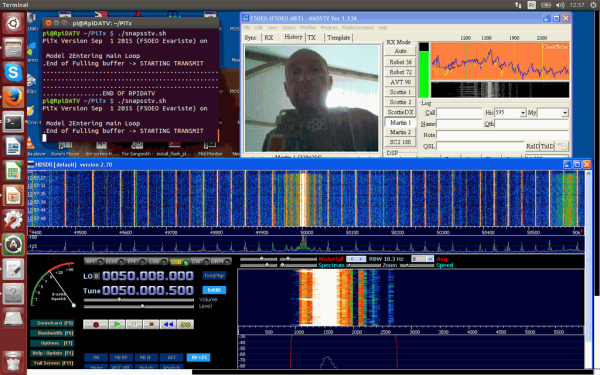

The most iconic thing you’ll find in a Fallout game is the Pip-Boy, the UI for the player and a neat wrist-mounted computer (that somehow has a CRT in it, I guess) for the player’s character. Hackaday’s own [Will Sweatman]

The most iconic thing you’ll find in a Fallout game is the Pip-Boy, the UI for the player and a neat wrist-mounted computer (that somehow has a CRT in it, I guess) for the player’s character. Hackaday’s own [Will Sweatman]